May 3, 2021

Friends,

I am excited to welcome you to the inaugural issue of my “An Entrepreneur’s Perspective” newsletter.

Entrepreneurs approach the world in a unique way. To us, the glass is always half full and problems are opportunities. There is always a creative solution or a way to make things better.

In this letter, I aim to provide An Entrepreneur’s Perspective on a range of topics including investing, politics, technology, and company-building. Hopefully, this will help to nourish your intellectual curiosity while introducing some new and creative ideas, in part by interviewing people I respect. At some point, I also plan to host a small networking conference.

As most of you know, 2020 was an eventful year for me. I largely closed the books on two successful and long-held enterprises, via the sale of InsiderScore and by starting to wind-down Raging Capital’s long/short fund. I am very proud of what I accomplished with these businesses.

I feel very fortunate and lucky. In addition to having more time to enjoy my family, I am now able to manage my own capital across a wider array of both public and private investment opportunities. I am also assisting a number of talented entrepreneurs and investors with their endeavors. Most of these various efforts will ultimately be consolidated under the Raging Capital Ventures umbrella.

I am hopeful that this newsletter can add value to you. I would very much welcome your feedback and ideas and would love to reconnect sometime soon. Please feel free to drop me a line. I plan to publish this letter on a roughly quarterly cadence. To subscribe (it is free), please click here.

Best Regards,

William C. Martin

Topics in this Issue of An Entrepreneur’s Perspective:

- Peeling Back the Archegos Onion

- China and a Carbon Tax

- David Swensen: The Biggest Investor Inflows Come Late in the Cycle

- An Undiscovered Gem in the Building Sector: Five Point Holdings

- Favorite Books & Media

Peeling Back the Archegos Onion

The implosion of Archegos is a very important market development and I hope regulators peel back the onion to truly understand what occurred.

Archegos owned massive swap positions in companies like ViacomCBS (VIAC), Discovery Communications (DISCA), Tencent Music (TME), and GSX Techedu (GSX), in some cases controlling 20-50% of their tradeable float. Swap ISDA agreements typically limit aggregate ownership in a single company to 4-9%. Archegos appears to have aggressively violated these limits and/or the prime brokers looked the other way, enabling the firm to corner numerous large stocks in the U.S. equity markets. Notably, Archegos owned perhaps 50% of the float of a reputed fraud, GSX.

How long has Archegos’ Bill Hwang been cornering stocks like this? He is rumored to have turned $200 mm into $5 b over the past six years (and may have briefly tripled that amount to $15 b during early 2021). What other short squeezes did he orchestrate in recent years? Are other funds using similar strategies as Archegos, and were there wolf packs of funds that Archegos was communicating with on these squeezes?

My hunch is that Hwang and his ilk have been cornering stocks for years, with the typical exit plan being the sale of his positions to passive indexes who are perversely designed to buy more of a stock the higher the price goes. This underscores a major issue with passive investing. Archegos’ machinations also created tremendous pain for short selling hedge funds, which provide a valuable ballast for the entire stock market.

Furthermore, if you peel back the onion enough, I think you will find an Archegos (or a similar fund) connection to Tesla (TSLA), which was squeezed multiple times until it was added to the S&P 500. Is it possible that Elon Musk, who regularly attacked the shorts, and who in 2018 was making unusual pre-market trades in his own stock at prices well above the prevailing market price, was somehow connected to this action?

China is now the tail wagging the dog in nearly every global market, and as a result I have spent a lot of time in recent years trying to understand the country better (See my 2018 China memo for more thoughts).

Sometime in the 2014-2015 timeframe, the Pentagon (finally) woke up to national security threat that China posed in the areas of artificial intelligence, quantum computing, drone and autonomous warfare, cybersecurity, and critical manufacturing. This started the tectonic policy shift that Trump brought to the political forefront, and for which Biden has bipartisan support to continue. While America’s policymaking may still be clunky at best, China is now clearly our country’s top foreign policy challenge.

A separate but major interrelated policy issue in the world today is climate change and the effort to transition the global economy to a more sustainable model of energy production. With technology innovation and cost curves now powering solar, EVs, batteries, etc., a “use tax” on carbon is becoming more appealing, even to a libertarian-minded free market capitalist like myself. The reality is that there are cost externalities inherent in utilizing fossil fuels; a use tax would properly price-in those costs and put cleaner technologies on a surer footing.

What does a carbon tax have to do with China? I think the United States has the opportunity to kill two policy birds with one stone by imposing a well thought out carbon tax policy.

More so than just taxing domestic consumption of fossil fuels at a higher rate, a use tax could be imposed based on the relative amount of carbon-inputs used to produce a particular good or provide a service. This tax would also apply to imported goods and services. Under this model, goods that are produced in China using primarily coal electricity, and which are then shipped thousands of miles globally using petroleum-powered ships (all of which are terrible for the environment), would be at a disadvantage to cleaner domestic production. Could you imagine the rush to localize farming and other manufacturing?

A carbon use tax would pressure China in a constructive way to tackle its environmental problems. It would also benefit American job creation and play to the strength of America’s leading industries (which are already fairly carbon efficient), such as pharma and health care, entertainment, software, and semiconductor design. The reality is our economy has been becoming more carbon-light for decades; even our remaining domestic manufacturing is centered around higher-end, less carbon-intensive pursuits (aerospace, specialized machinery, etc.).

Much work would obviously need to be done to devise an eloquent way to calculate this carbon tax, such as some kind of cross between the BTU and the VAT. Surely, though, the idea of taxing undesirable pollution, thus incentivizing alternative free market approaches, is a far better policy approach than providing direct subsidies to companies or industries that are picked by a bureaucrat. In sum, a carbon use tax would help lead to a cleaner environment, encourage onshore sourcing, and create all sorts of thorny issues for China.

David Swensen: The Biggest Investor Inflows Come Late in the Cycle

As we watch soaring equities, crypto-currencies, venture capital and other assets attract record amounts of new investment inflows, a past lecture by Yale’s David Swensen’s on market-timing provides a great reminder of the negative implications of chasing performance:

“Morningstar did a study of all of the mutual funds in the U.S. domestic equity market, and there were 17 categories of funds. And what they did with this study is, they looked at 10 years of returns and compared dollar-weighted returns to time-weighted returns. The time-weighted returns are simply the returns that are generated year in and year out. If you get an offering memorandum or a prospectus, they’ll show you the time-weighted return. If you look at the advertisements, where Fidelity is touting its latest, greatest funds, the returns that you see are time-weighted returns.

“Dollar-weighted returns take into account cash flow, right? So, in a dollar-weighted return, if investors put more money into the fund in a particular year, that year’s return will have a greater weight in the calculation. So, here we have all the mutual funds in the U.S., 17 categories, time-weighted versus dollar-weighted. In every one of those categories, the dollar-weighted returns were less than the time-weighted returns. What does that mean? That means that investors systematically made perverse decisions, as to when to invest and when to disinvest from mutual funds.

“What investors were doing, they were buying in after a fund had showed strong relative performance and selling after a fund had shown poor relative performance. So, they were systematically buying high and selling low, and it doesn’t matter whether you do that with great enthusiasm and in great volume, it’s a really, really bad way to make money. Very difficult. So, the conclusion for these individuals that operate in the mutual fund market, is that their market timing decisions were systematically perverse.

“I also took a look at the top 10 Internet funds during the tech bubble, something I published in my book for individual investors. And if you looked at the top 10 Internet funds three years before and three years after the bubble, the time weighted return was 1.5% per year. You look at that and you say, 1.5% per year, well, the market went way up and way down, but 1.5% per year, that’s not so bad. No harm, no foul. However, investors invested $13.7 billion and lost $9.9 billion, so they lost 72% of what they invested. How could it be that they lost 72% of the money that they invested, when the time-weighted return was 1.5% per year for six years? Well, they weren’t invested in the Internet funds in ‘97, and they weren’t invested in ‘98, and they weren’t invested in early ‘99. It was in late ‘99 and early 2000, that all the money piled in at the very top. And then, in 2001 and 2002, bitterly disappointed, they sold. So, they lost 72% of what they put in, even though the time-weighted returns were 1.5% per year positive.”

An Undiscovered Gem in the Building Sector: Five Point Holdings

It is not easy finding undervalued investment ideas in this bull market, but Five Point Holdings is an attractive and timely off-the-radar name in the red-hot building sector.

Five Point Holdings (FPH) is a California land developer that was spun out of Lennar (LEN) and which went public in 2017 at $14 per share. Shares have struggled in recent years, recently trading at $7.25 per share, due to the inherent lumpy cash flows of a development-stage land company and a small float, with LEN still owning ~40% of the company. However, FPH has made steady progress with its projects while the macro environment has accelerated.

What’s most exciting about FPH is its Valencia community, which is a carbon neutral project that encompasses 15,000 acres, 21,000 homesites, and 11.5 mm square feet of commercial space in Los Angeles County. This is the largest new homebuilding project in California today. After nearly 20 years of planning, permitting and setup work, Valencia is now “shipping” completed lots to builders in a housing market that’s desperate for inventory. Los Angeles housing prices are up 15% alone over the past year, which should provide a windfall of operating leverage for FPH. Valencia is poised to create a torrent of free cash flows, adding to the company’s rock solid balance sheet. Similar to Howard Hughe’s (HHC) Woodlands or Summerlin planned communities, Valencia is a massive project that is going to provide dividends for decades to come.

FPH is also poised to benefit from cash flow distributions from its more mature Great Park project in Irvine. Specifically, the company said that it expects to receive over $100 million in dividends this year from Great Park as the project reaches certain return hurdles. Further, FPH recently shared that it believes the permitted density of Great Park could significantly increase, thanks to efforts by the State of California to help alleviate housing shortages by easing up on development rules.

FPH’s other big project is the San Francisco Candlestick Park / Navy Shipyard project, which had been previously slowed by environment cleanup challenges. With Kamala Harris (a former San Fran pol) now in the White House, it appears the red tape on this project is being lifted and FPH could start development as soon as 2023.

Trading at roughly half of its IPO price and a roughly $1 billion market cap, FPH is overdue to play catch-up with the rest of the housing sector as the cash flow of the business materially inflects this year. Indeed, management is rumored to be planning a June investor day. I would not be surprised if investors rediscovered this orphaned name.

(Full Disclosure: Long FPH)

Nick Kokonas – Know What You Are Selling

A co-founder of the amazing 3-star Michelin restaurant, Alinea, Nick Kokonas started Tock after having the idea to charge an upfront fee for a restaurant reservation. This simple idea, which no one believed could work, has radically improved restaurant economics. A great business case study.

Bob Pittman – Lessons from Building Media Empires

The founder of MTV, Bob Pittman, who has proven to be a great business operator over four decades, is now reinventing iHeartRadio (IHRT). His big lesson? Provide convenience for consumers. A fun listen.

https://podcasts.apple.com/us/podcast/invest-like-the-best/id1154105909?i=1000502685672

**

Chris Dixon – The Potential of Blockchain Technology

Marc Andreesen’s longtime partner, Chris Dixon, provides a great primer on potential applications for blockchain, which he views as a new, decentralized computing platform that is differentiated by a new feature called a “trust guarantee.”

Peter Thiel: Could China Weaponize Bitcoin?

https://www.coindesk.com/peter-thiel-china-weaponizing-bitcoin-politics

Given Thiel’s stature and connections, this does not seem like an idle comment. Playing Devil’s Advocate, though, I wonder if the U.S. could instead co-opt and use bitcoin against China by offering the lowest global taxes on bitcoin and by creating a special U.S.-based court system (accessible by paying a small transaction tax) to adjudicate bitcoin-related disputes? This could help to undermine China’s capital controls, while also effectively creating a new seamless digital onramp for developing countries to the USD-dominated global economic system. U.S. tech companies would certainly thrive in this world.

**

The Miseducation of America’s Elites

By Bari Weiss, March 9, 2021

A story that hits close to home, as my wife and I deal with a watered-down curriculum and an aggressive social agenda at one of the schools that two of our three children attend here in Princeton. Ms. Weiss’ free email list is a must-subscribe.

https://www.city-journal.org/the-miseducation-of-americas-elites

**

Theodore Rex

By Edmund Morris

It was so refreshing to read about a true and great leader with such intellectual firepower. Theodore Roosevelt’s presidency dealt with many similar issues that are top-of-mind today: race-based politics (then in the aftermath of the Civil War); capital vs. labor tension; and dominant Trust monopolies due to the maturation of an economic revolution (then industrial, now technology). He also successfully pushed to build the Panama Canal, enabling America’s Manifest Destiny by enhancing both our trade and naval power by uniting the country’s Atlantic and Pacific navies. Oh, and Teddy also established 150 national forests, 50 bird reserves, five national parks, and 18 national monuments!

Einstein: The Man, The Genius, and the Theory of Relativity (The Kid’s Book Version!)

By Walter Isaacson

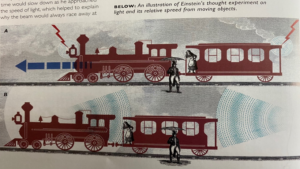

I love Isaacson’s writing, most specifically in his book on Steve Jobs. However, I could never make headway with his book on Einstein; it was just too deep given the nature of Einstein’s work. The kids’ version, though, with simple writing and lots of pictures, made complete sense to me. I highly recommend it!! See more below:

Einstein’s Theory of Relativity Thought Experiment: Suppose lightning bolts strike both ends of a fast-moving train. If a man standing on the platform halfway between the two strikes sees the light from each strike at the exact same moment, he would say that the strikes were simultaneous. But now let us imagine how it looks to a woman at the midpoint inside the train. In the nanosecond it takes the light from the bolts to get to her, she will have moved forward a tiny amount. The light from the front strike will get to her first. She would say they were not simultaneous.

**

Fortuna Audaces Iuvat – Fortune Favors the Bold!