April 14, 2022

Friends,

I am excited to interview my friend, Adam Wyden, for this issue of An Entrepreneur’s Perspective.

Adam runs ADW Capital, a $300 million investment fund based in Miami. He started ADW in 2011 as a relatively young man and has compounded at roughly 24% per year net through the end of 2021. In my view, he is one of the best and most disciplined stock pickers in the business; he once told me that his goal is to “buy scarce assets at the right price.” Well-stated. Additionally, Adam has incredible work ethic and passion for the business. Proudly, I have been an investor in ADW for nearly a decade. I hope you find value in this interview.

I am also excited to announce Raging Capital Ventures’ inaugural Ideas & Networking Conference on September 22, 2022 in New York City. We will be hosting a lunch along with a series of interesting speakers, panels, and networking opportunities in the afternoon. We will provide more details about this event in the coming months. Please save the date and/or contact: [email protected] to be contacted when registration is available. I hope you can attend.

Thanks again and I look forward to connecting sometime soon.

Enjoy!

Best Regards,

William C. Martin

Topics in this Issue of An Entrepreneur’s Perspective:

- Interview with Adam Wyden, ADW Capital

- Two Favorite Energy Sector Dividend Stocks

- Favorite Podcasts & Media

- Recent Tweets from @RagingVentures

**

Interview with Adam Wyden, ADW Capital

When I first got to know you back in 2009, and we began to regularly trade ideas and data points, I was always impressed with your level of diligence and hustle. In fact, I assumed you were an analyst at another hedge fund, even though you were still a student at Columbia Business School! As a self-starter, what got you interested in investing and what led you to originally start your fund?

I can trace my lifelong passion for investing back to two important people: my great uncle Stanley and my grandmother. My uncle was a day one investor in Price Club and Qualcomm and espoused a simple but potent philosophy: invest with people who have more to lose than you do. My grandmother taught me the 8th wonder of the world: compound interest. Armed with this knowledge, I worked one summer in college for a large fund, but was disappointed to find the investment focus was on quarters instead of years (or even decades). I had some success investing my own modest bankroll in the turbulent months of 2009 and steadily developed the confidence to run other people’s money in addition to my own. I launched the fund with less than $1m in 2011 and today we manage nearly $300m (and I am the largest investor).

Tell us about your investment process and work habits.

Because I make so few investments, I tend to be a voracious consumer of information about each company — both before and after it is in the portfolio. I view the biggest risk to my strategy as my missing a shift in the competitive landscape for any of my portfolio businesses. This necessitates staying close to not only my management teams but also those of competitors and any prospective new entrants. This process is ongoing but I am a 24/7 guy so it’s a good fit for my natural habitat.

I’ve also always been intrigued by your ability to sit on your hands and be patient (something I often lack!). In fact, I recall you not even buying a single stock during much of 2018 or 2019… allowing you to capitalize on the COVID sell-off. Share with us how you’re able to sit tight and stick to your guns?

I wish I could say that I have always been patient at the right times, but that skill set remains a work in progress! I had some things in the portfolio that I knew I needed to divest and did so over 2018 and 2019, which ultimately proved propitious. I was, as you note, cautious to reinvest over the course of 2019 because I felt like the types of things I look for were all priced too high. To use an analogy I am fond of, I want to find scratch-and-dent inventory that is in need of some polish before it’s good as new. In 2019, all the stocks looked like they were “showroom quality” to me. Fortunately, I was able to find plenty of opportunity throughout 2020 — and some of what I own today is even cheaper than during COVID on an earnings-adjusted basis!

My favorite trade of yours was the Ferrari (RACE) spin-out from Fiat (FIAT). Even though both companies were very well known, almost zero US-based investors were paying attention. Tell us about how you discovered and executed on this idea.

Well first of all, cars have been a passion of mine for as long as I can remember — in fact, I used to have a car detailing business in high school. I was able to approach the situation with what proved to be an accurate but highly differentiated view. I never looked at Ferrari as just a car, but rather a true luxury brand, like Patek Phillipe or Hermes. That they happen to produce vehicles you can drive seemed incidental — even distracting — in determining what the brand was worth. When FIAT first released segment financials on Ferrari in advance of the spinout, that left me a trail of breadcrumbs to the unit economics and helped me assess how big and profitable Ferrari would ultimately be.

I personally think APG is one of your best current ideas, and that’s even after it has gone up 200-300%. Can you share your thoughts here?

There was a lot of value created at APG right from the beginning. Martin Franklin was able to buy the company cheap from an owner who didn’t want to see his life’s work sold off for parts by private equity. Similar to Ferrari, I had a slightly differentiated view on this one which can be summed up quite simply: fire safety isn’t optional. This proved to be true, even during the pandemic, as the market began to appreciate that APG’s revenue is “bulletproof” even in the most dire circumstances. With the acquisition of Chubb’s business, APG is now at the top of the food chain, yet still arguably trades at a 75% discount to comparable private market transactions on 2023 projected numbers. I think the public market needs some time to wrap its head around the dynamics, but I don’t lose any sleep over the terminal value of APG.

Any other favorite names you’d like to mention?

We got involved last year in a Swedish e-commerce business called CDON where we are now the largest shareholder. In spite of widespread internet access, rule of law, and high per capita GDP, Sweden has never enjoyed the same delivery lifestyle we have here in America. Amazon has made a foray into the Nordics but it was largely a flop — and they fulfilled orders out of Germany, foreclosing any prospect of same-day delivery. CDON was originally a 1P marketplace, selling CDs and DVDs over the internet. Only recently did a sophisticated local investment group, Rite Ventures, take control and undertake the transformation into a true 3P marketplace like Amazon or Etsy. To be clear, this is a longer term play, but at today’s valuation, we see the prospect of earning many times our money in a business that absolutely has to exist.

Given your unique path, I’d love to hear any advice you have for younger investors folks just starting out in this business?

I think the best advice I have to offer to anyone considering launching a fund is to have real proof of concept. While the rewards are sometimes considerable, this business is isolating, frustrating, and more often than not requires you to do nothing rather than something. In order to have the conviction necessary to execute on that, you need to have a formula, a program, that you have battle tested through good times and bad. I only started my own fund because I had proved to myself that I had an approach that could make money — which I did on my own dime first.

**

Two Favorite Energy Sector Dividend Stocks

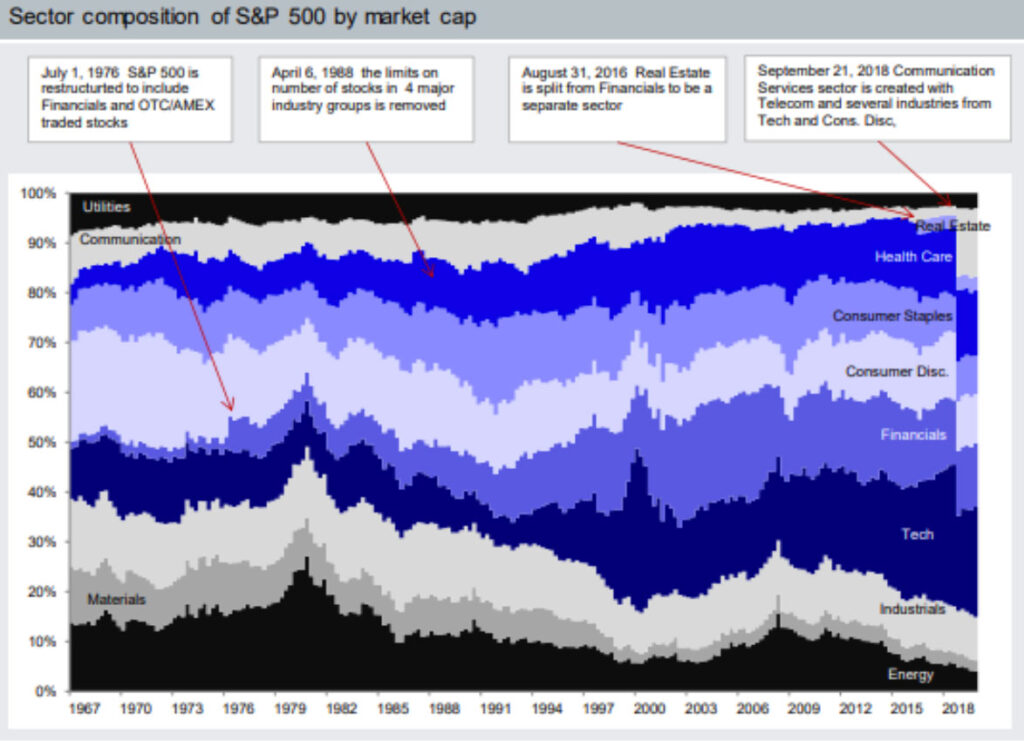

Energy shares had a strong first quarter, as the potent trifecta of inflation, chronic industry underinvestment and war made investors rethink their longtime aversion to the group. Amazingly, even after rising 50%+ in 2021, the energy group still accounted for less than 3% of the S&P 500 index at year-end!! Amid this backdrop, I wanted to share a couple of interesting charts as well as a pair of high-yielding energy stocks that are off-the-beaten path and potentially worthy of your attention. First, the charts:

ENERGY SECTOR WEIGHTING S&P 500 – fell to less than 2% in October 2020, and is still less than 5% of S&P 500!

IN CONTRAST: APPLE NOW ACCOUNTS FOR 7.1% OF S&P 500 ALONE

Now, my two ideas:

Crestwood 9.25% Perpetual Preferred (CEQP.PFD): Trading around $9.65, the Crestwood preferreds offer an attractive and unusually well-protected 8.8% yield. Crestwood (CEQP) is a diversified and well-run MLP that I have been invested in for over 8 years. The partnership provides gathering, transport, storage and marketing services to a wide range of customers in key basins such as the Bakken, Permian, Powder River and Marcellus. Crestwood’s common dividend is 2x covered, leverage is reasonable at around 3.5x, and capital expenditures are self-funded. Crestwood’s recent combination with Oasis Midstream created further scale for the company in the Bakken region, while also strengthening the company’s capital structure (good for the preferreds).

Originally issued in 2014 to Magnetar and GSO, these preferred securities have a $9.13 par and provide unusually strong protections for holders, including: no redemption or call right by the company; cash-paid only (no PIK option); and cumulative (if a payment is missed, distributions immediately step up to 11.25% and increase further each quarter). In the event of a change of control, holders may elect to 1) convert to common (at $91 per CEQP share, not a great deal), 2) continue holding the preferreds, or 3) require redemption at $9.2185 per share.

Over two-thirds of Crestwood’s cash flows come from natural gas and liquids production, which have strong growth tailwinds. Recent energy shortages in Europe due to developments in the Ukraine and weather underscore the value of U.S. natural gas; even Democrats might agree with that statement today! For yield-orientated portfolios, the Crestwood Pfds are compelling and more attractive than the common equity.

You can view Crestwood’s recent presentations here: https://www.crestwoodlp.com/investors/events-and-presentations/default.aspx

PrairieSky Royalty (PSK.TO): PSK is a Canadian Royalty Trust (trading in Toronto) that owns perpetual fee simple and royalty rights on over 18 million acres of land in Western Canada, including in key basins such as the Duvernay, Cardium, Viking, and Clearwater. As a royalty owner, PSK leases out land to operators and is generally paid a gross overriding share of revenues. Importantly, PSK does not incur any capital expenditures. The company went public in 2014 and has paid out over $1.2 billion (CAD) in dividends since. Bob Robotti, a friend and noted value investor, joined the board in 2019.

The stock currently only yields 2.8%, but that dividend run rate is 3-4x+ covered. This implies a ~10% earnings yield on the equity (again, with no capital expenditures and the company has large tax shelters), and that earnings number is likely meaningfully higher at recent oil and gas prices. The company has used its excess cash to make intelligent acquisitions (or to pay off debt associated with those deals), including a large and timely $728 million (CAD) purchase in November 2021 of a high-quality portfolio of land rights from the Ontario Teacher’s Pension, which was forced to divest these assets due to new ESG policies. The company has also been steadily buying back its own stock, with both per share production and acres-owned continuing to grow.

So why is PrairieSky attractive now? During the oil price crash, PSK reset their dividend lower, crushing the stock from which it has yet to fully recover. Further, the current dividend yield is probably superficially too low to interest many investors, even though the stock is quite cheap when you include all of the free cash flow being generated. Therein lies the opportunity, and investors should be well-rewarded by growing dividends and buybacks well into the future.

You can view their February 2022 corporate presentation here: https://www.prairiesky.com/wp-content/uploads/PrairieSky-Royalty-Presentation-February-7-2022.pdf

**

Favorite Books & Media

Mark Zuckerberg with Tim Ferriss on Management, Stress, Building the Metaverse, and more

Listening to Mark Zuckerberg, one of the great entrepreneurs of our time, for 1.5 hours is truly worth its weight in gold. The discussion of the metaverse is interesting, but what I found most compelling was Zuck talking about how he manages stress (he seemed acutely aware of how much of this he has!) and his schedule.

https://tim.blog/2022/03/24/mark-zuckerberg/

Steve Papa – Entrepreneur’s Perspective on Venture

Ted Seides interviews Steve Papa with a focus on Steve’s entrepreneurial background and his approach to venture investing. Steve offers a wide range of wisdom and discusses why he likes to bet on specific people and why he often avoids companies that are popular with VCs. This podcast is a great follow-up to our recent Papa interview: https://ragingcapitalventures.com/an-entrepreneurs-perspective/

Luke Gromen on the Grant Williams Podcast

A fascinating discussion of monetary history and the role of the U.S. dollar as the global reserve currency. Luke believes that it is now in the interest of both the world and the U.S. to evolve this system, with recent sanctions on Russia’s Central Bank serving as a key catalyst for change (and is as important as when Nixon closed the gold window). Thoughtful and worth a listen for sure.

The Grant Williams Podcast: Luke Gromen

Ukraine Crisis – What it Means for the West (2014), by Andrew Wilson

Written after the crisis in Crimea in 2014, this book provides an excellent outline of the state of play with Ukraine and Russia. It specifically digs into the history of the two countries, demographic trends, and the fall-out of Russia’s actions in Crimea. Most interestingly, it highlights the immense level of corruption that exists throughout both the Russian and Ukraine political and business systems, as well as the various methods of corruption and bribery that Russia has used to gain political influence/control in Ukraine. This is a good primer for what’s going on today.

https://www.amazon.com/Ukraine-Crisis-What-Means-West/dp/0300211597

Once Upon a Time in Russia: The Rise of the Oligarchs, by Ben Mezrich

A worthy beach read, author Ben Mezrich tells a quick and entertaining tale (loosely based on facts) of the rise of Russia’s oligarchs and Vladimir Putin. The book discusses Putin’s rise to power, digs into the rise of Roman Abramovich and others, and provides background on infamous developments like Putin’s usage of Polonium in a London poisoning of an enemy. In short, Putin plays hard ball in a system filled with a lot of tough characters.

https://www.amazon.com/Once-Upon-Time-Russia-Oligarchs_A/dp/1476771901

Peter Chernin – Betting on Passion

Patrick O’Shaugnessy interviews well-known media executive (News Corp. and Fox) Peter Chernin, who shares a range of experiences and insights from over the years. He specifically discusses Rupert Murdoch, Barry Diller, and director James Cameron, and talks about the changing media landscape. An enjoyable listen.

https://podcasts.apple.com/us/podcast/peter-chernin-betting-on-passion/id1154105909?i=1000550416887

**

A Selection of Recent Tweets from @RagingVentures:

Early stage VC Q1 letter: "starting to see valuation reductions in the public markets make their way into the private markets, from the growth stage all the way down to seed." Noted they are seeing "later stage VCs pulling back on term sheets or offering unfavorable terms."

— Raging Capital Ventures (@RagingVentures) April 7, 2022

I thought this tidbit on $ACTG from Craig Hallum was notable. As far as I recall, the company had never previously discussed the Mycovia royalty in a prominent way before. pic.twitter.com/7rzytSAPj4

— Raging Capital Ventures (@RagingVentures) April 4, 2022

A small player, but $HNST shortfall provides notable read-throughs: Says online shopping activity is falling in their categories as consumers go back to stores. And with generally fewer online shoppers, digital marketing costs are rising 20-30% as everyone chases fewer consumers.

— Raging Capital Ventures (@RagingVentures) March 25, 2022

Congrats to the team at Shield Capital on exceeding their $120 mm target for their first venture fund. Shield is focused on AI, space, autonomy & cybersecurity, all of which are critical to national security. We are proud to be investors. Good luck, Shield!https://t.co/pqm5ULHgkL

— Raging Capital Ventures (@RagingVentures) March 21, 2022

Thoma Bravo paying 14x NTM revenues for $PLAN, an enterprise software company with ~30% revenue growth and a very sticky solution. This is a nice price that should provide SaaS investors with a good comp in this turbulent market.

— Raging Capital Ventures (@RagingVentures) March 21, 2022

Thought this was an interesting tidbit… in 2014, the Ukraine leased 10% of its arable land – an area as large as Belgium – to China to grow crops. pic.twitter.com/2Ub7lrk0YU

— Raging Capital Ventures (@RagingVentures) March 5, 2022

I was worried that Lennar might try to steal $FPH. This quote from Lennar's CEO (& new $FPH Exec Chair), Stuart Miller, suggests the opposite… Miller, who has an excellent track record, is making changes and focused on unlocking shareholder value. Exciting times for $FPH. https://t.co/QaSSLfClwR pic.twitter.com/YomMHjxoKU

— Raging Capital Ventures (@RagingVentures) March 1, 2022

$TOST's Q was solid, ending '21 w/ 57,000 live restaurants (+38% yoy), or ~7% market share. Avg. volume per restaurant ("GPV") is $1.3 mm.

ARPU increased 30% yoy and 59% of customers use 4 or more modules, up from 48% last year. Payback on customer acq was just 12 months. 1/3

— Raging Capital Ventures (@RagingVentures) February 16, 2022

$SIRI announced a $1 b special div payable in Feb. $LSXMK / $LSXMA, which currently trade at a -30%+ discount to my estimate of NAV, will receive $800 mm from the special div. I think it is safe to assume that that $ will be used for accretive buybacks… https://t.co/IF8Sdq3CIb

— Raging Capital Ventures (@RagingVentures) February 1, 2022

**

Fortuna Audaces Iuvat – Fortune Favors the Bold!