January 26, 2022

Friends,

I am excited to interview Steve Papa for this issue of An Entrepreneur’s Perspective.

Steve is one of the most accomplished serial entrepreneurs of our time. He has extraordinary creativity, energy and vision, with the rare combination of both software and hardware (including semiconductor) expertise. Many of his projects involve multi-year bets on the direction of Moore’s Law, hardware price deflation, and telecom network capabilities.

Steve’s first big win was Endeca, an enterprise search engine company focused on e-commerce that he started in Boston in the late 1990’s. My first company, Raging Bull, was also based in Boston during this time and, even then, there was tremendous buzz about Steve among local entrepreneurs.

I was lucky to finally meet Steve after he had successfully sold Endeca to Oracle. From there, we started grabbing regular breakfasts to share notes and ideas when he visited Princeton as part of an advisory role with Princeton University’s Engineering School. I quickly determined that I wanted to be in business with Steve.

Toast was my first opportunity to bet on Steve. Started by a group of engineers from Endeca, Steve provided critical funding and vision during Toast’s early years. While many venture investors were tentative, we were excited about Toast’s cloud-based operating and point-of-sale system for restaurants and Raging Capital became the company’s first institutional backer! (Much more on Toast below…)

Subsequently, Raging Capital and I have invested in several of Steve’s projects, including Parallel Wireless, Kandou, and ClearBallot. We will discuss some of these companies more in the interview that follows. Notably, Steve is also on the board of Desktop Metal, a super-interesting player in next generation 3D printing that went public last year. My kids own Desktop Metal in their college investment accounts.

I very much value my relationship with Steve and can’t wait to see what he builds in the future. Thanks for sharing your thoughts, Steve.

Enjoy!

Best Regards,

William C. Martin

Topics in this Issue of An Entrepreneur’s Perspective:

- Interview with Steve Papa: Building the Future of Technology

- Why I am Bullish on Toast

- Exterran and Enerflex Merger is a Potent Combo

- Favorite Podcasts & Media

- Recent Tweets from @RagingVentures

Interview with Steve Papa: Building the Future of Technology

Steve, thank you so much for taking the time to share your thoughts. Your background is amazing. To start, it would be great to hear what first sparked your original entrepreneurial energy? What made you start Endeca?

Well, the original entrepreneurial energy goes back to being a teenager and doing landscaping, contracting, repairs, you name it. Then, at University, where it was everything from building lofts in dorm rooms to selling tuxedos. But I then had the good fortune to be early at one of the iconic late ‘90s Internet companies – Inktomi, where my front row seat made me energized by the innovation and tech company building process.

You ended up selling Endeca to Oracle for a nice price, but it was after a tough slog through the dot com shakeout and then the Great Financial Crisis. What did that period teach you about building a business? What made you so excited about seeding multiple entrepreneurial endeavors thereafter?

Endeca was a lot of hard work, and our #1 asset was perseverance. That said, there also is an appreciation of the role that luck played in our success along the way. The best example of luck that comes to mind was Endeca’s critical funding round in September 2001, which was largely the result of a summer barbecue with a venture capitalist and his neighbor that was one of our early adopter champions. Observing the power of luck leads one to consider the power of portfolio theory!

Toast has been your biggest home run — so far! Yet, restaurant software is also one of the most fragmented and tough markets. What made you bet on Toast and what have been the keys to their success to date?

Toast was a bet on people – talented individuals I had the privilege of working with closely at Endeca. We were fortunate and had great luck early on to be the first company to discover the vertical SAAS payments business in that industry. That discovery opened a wormhole for disruption that Toast aggressively executed on with great speed to become the industry leader while also apparently closing that wormhole to others.

What are you most excited about Toast when you think about their growth opportunities over the next 10 years?

Toast’s potential is still in its infancy. If you think about what McDonald’s does for its franchisees to give them leverage, imagine Toast having a similar impact (less the menu/marketing standardization) on the SMB/mid-market segment. There’s a massive runway of innovation to come.

I’ve told friends that, as big of a success that Toast has been, I think Parallel Wireless might actually be your big idea! Tell us more about Parallel Wireless.

The global wireless infrastructure rivals the webscale datacenter in its overall scale and, unfortunately, energy consumption. But, while the datacenter moved on from dinosaurs like Digital Equipment Corporation, wireless infrastructure has not. Our work has been part of what has inspired the global OpenRAN movement – a movement to bring the openness and pace of innovation that exists in the datacenter to the world of wireless infrastructure. It is a massive market where hundreds of billions are spent a year on infrastructure globally. We’ve been building the software to enable the upgrade of the brownfield global wireless network – 2g, 3g, 4g, and 5g.

When will Parallel start to see larger deployments? How strategically important is Parallel to the USA as we try to counterbalance China in wireless tech?

Parallel Wireless is now delivering KPIs at parity with incumbents (Ericsson/Huawei), which enables us to start scaling to deployments larger than the roughly 1,000 site networks we are powering today. It is very strategically important to the U.S. because China will be able to develop an indigenous semiconductor industry through Huawei’s dominance in infrastructure – the volumes are such that it can make or break the U.S.’s position in the global semiconductor industry.

Semiconductors are a high barrier to entry business, keeping most players out, but you’ve been one of the few entrepreneurs who’s aggressively worked to enter the industry, both at Parallel and Kandou. Can you tell us a bit more about your views in this area?

When I got involved in semis it was because nobody was interested, and my view was that they are crucial for keeping the entire innovation flywheel going. It was a decade ago when I observed that, and sure enough, there has been lots of attention paid since then. My view was that innovative silicon would ultimately become a scarce asset in a critical global industry. That’s largely been proven true and we will see how it plays out over the next few years.

Thank you so much, Steve. Good luck!

**

Why I am Bullish on Toast

Proudly, Raging Capital was Toast’s (TOST) first institutional investor in 2015 at just 34 cents per share, or a valuation of around $100 mm valuation. The company went public in September 2021 and now trades around $22 per share, with the company now worth more than $12 billion. I wanted to share some first-hand perspectives on Toast and its growth opportunities.

As I noted earlier, and Steve Papa describes in further detail in the interview above, the founders of Toast came from Endeca, a successful enterprise search engine company that was acquired by Oracle. Given this success, the Toast team had incredible street cred and was able to hire the best-of-the-best Boston engineers to build and iterate a cloud-enabled software stack for restaurants.

Toast differentiated itself with its early bet on the cloud, as well as by embedding payments in the software, utilizing low-cost Android-based hardware, and targeting SMB restaurant-operators. The focus on SMB was a bit counterintuitive, as many upstarts at the time focused on selling to big chains. Large restaurant groups, however, usually require long sales cycles and custom software development, and they are often unwilling to share much of the payment margin or consider adopting add-on modules like payroll or marketing. Additionally, even today, many chains aren’t quite ready yet to upgrade to the cloud.

Toast also cracked the nut of figuring out how to cost-effectively sell to SMBs, putting feet on the street in most major cities in the US. This enables Toast to go door-to-door to make sales, whereas other competitors often sell through distributors (and Square is largely do-it-yourself, limiting it to the low-end of the market). Toast’s approach has paid dividends: Toast now powers over 50,000 restaurants, or almost 10% of its target market, with a historical customer acquisition payback period of only around 18 months. This has translated into capital efficient growth, with Toast having only spent around $500 mm since inception to reach its current ~$600 mm in annual recurring revenue (“ARR”).

Importantly, management has proved its mettle as a nimble and fast-paced innovator and operator, particularly during COVID. Ironically, while certainly a huge challenge, the pandemic proved a blessing in disguise – as restaurants were forced to upgrade their legacy solutions to support online ordering, take-out, QR codes, pay-at-table, and the like. Toast was quick to provide these solutions to help keep restaurants in business. This digital upgrade cycle is still nascent, providing a long runway for growth. Analysts think Toast can double or triple its restaurant count over the next few years.

As the de-factor operating system for many SMB restaurants, Toast has numerous upsell growth opportunities:

- Payroll: Toast is beginning to upsell payroll and other human resource solutions to its customers, after acquiring StratEx in July 2019. This integrated solution is a huge time saver for restaurant owners, many of which are still manually entering tips from their point-of-sale system into payroll. Toast eliminates this issue. Restaurants in the U.S. account for ~8% of the entire labor force, so the size of the market is vast. Toast is already seeing a large percentage of its new customer wins adopt payroll, in the process nearly doubling what it can charge for its software subscription.

- Marketing/CRM: Toast offers a module that allows restaurant owners to maintain their customer relationships, offer loyalty and gift card options, and track marketing efficiency. Think HubSpot for restaurants.

- Inventory Management: Toast acquired xtraCHEF in 2021, a provider of financial management solutions around inventory, food cost, and recipes. This is another invaluable offering for SMBs, many of which don’t have access to these types of solutions.

- Supply Chain / Procurement: Over time, Toast is positioned to help to digitize and automate back-office paperwork, including by offering payment cards as Bill.com does. Also, it could help create purchasing efficiencies for small restaurant operators by aggregating the scale of its large restaurant base (who individually lack purchasing scale) to negotiate better prices.

Toast will also expand internationally, although this is still a nascent effort. It will be interesting to see how they choose to attack this opportunity. Toast Capital, which provides targeted lending solutions for restaurant operators (Think: AmEx Business Credit), is another future growth vector. Additionally, although it has intentionally not aggressively pursued large chain restaurants, it is likely that Toast will ultimately get drawn into those opportunities given the breadth and quality of its software stack. Plus, there are numerous opportunities to build or buy valuable additional add-on modules that can add to the Toast software stack.

I believe Toast can grow to $1 billion of ARR over the next 4-6 quarters, with a runway to grow 30-40% for many years and build a multi-billion-dollar ARR business. As Steve Papa said above, “If you think about what McDonald’s does for its franchisees to give them leverage, imagine Toast having a similar impact (less the menu/marketing standardization) on the SMB/mid-market segment.” The payroll opportunity alone could be worth more than the value of the entire company today. With the stock around $22 per share, I think it is again a great entry point for long-term orientated investors to be buying the stock.

For additional perspectives, I would encourage you to review the above interview with Steve Papa, as well as listen to this podcast with Alex Rampell, a General Partner at Andreessen Horowitz. Alex talks in detail about “vertical” software operating systems, with a large amount of discussion about Toast throughout:

Investing in Operating Systems: Alex Rampell

Good luck, Toast!

**

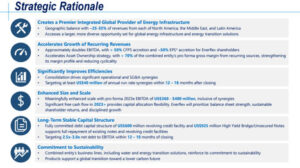

Exterran & Enerflex Merger is a Potent Combo

In October, we profiled Exterran (EXTN) as a speculative stock idea with “multi-bagger potential.” Earlier this week, the company announced that is being acquired by Enerflex (EFX.TO) in an all-stock deal (1.02 shares of Enerflex per Exterran share). This is a match made in heaven, as it will combine two of the leading international providers of natural gas processing and compression solutions. The deal will create scale efficiencies and lead to more than $40 mm in synergies, while also solving for EXTN’s balance sheet challenges (combined net debt will fall to less than 3x EBITDA). Shares of the new company will trade in both Toronto and New York.

The combined entity, in which EXTN holders will have a 27.5% stake, currently has an implied market cap of around $700 million and an enterprise value of around $1.4 b, which is less than 4x ’22 pro-forma EBITDA. Management expects the combined business to generate $200-$250 mm of discretionary free cash flow from operations in 2023, equal to a greater than 25% cash flow yield on the equity. Both companies are beginning to enjoy improved volumes and backlogs due to the recovery from COVID as well as the increasing demand for natural gas and emerging opportunities in water treatment.

Enerflex will need to get regulatory approval in a “handful” of countries, which it expects to receive within the next 4-6 months. We do not anticipate problems here, particularly with limited operational overlap in the United States.

We would continue to hold EXTN shares as they appear materially undervalued. For example, at 6x pro-forma ’23 EV/EBITDA, Exterran would trade at $10-$12 per share in USD versus its recent $4.75.

Original 10/21/21 EXTN write-up:

“Exterran (EXTN): In the speculative camp, EXTN has multi-bagger potential as its markets recover from the energy bust and it transitions to a more capital-light business model. Specifically, EXTN could secure an “offtake” partnership with an infrastructure investor with a low cost-of-capital who desires the company’s water solution deals for ESG reasons. This would enable EXTN to convert a portion of its business to more of an origination and servicing model, freeing up cash flow and accelerating de-leveraging. Sam Zell owns 25% of the company and has strong influence on the board; he also bought more stock in Q2 at around these levels.”

**

Favorite Books & Media

Josh Wolfe, Lux Capital – Inventing the Future

I’ve heard Lux Capital’s speak many times, but he is at the very top of his game in this discussion with The Knowledge Podcast. His views on emerging tech trends are worth their weight in gold, as are his thoughts on how he consumes information/connects the dots.

https://fs.blog/knowledge-podcast/josh-wolfe/

Bill Gurley, Philip Rosedale – Back to the Future

This Invest Like the Best podcast with venture capitalist Bill Gurley and Second Life founder Philip Rosedale takes a deep look at the potential metaverse opportunity, shares some lessons from Second Life, and brainstorms on how the ecosystem could evolve.

https://www.joincolossus.com/episodes/43447310/gurley-back-to-the-future?tab=blocks

Hoover Institute Goodfellows: Schmidt Happens

In an open and candid conversation, Eric Schmidt explores the potential upside, risks and implications of the emerging “Age of AI” along with Niall Ferguson, H.R. McMaster, and Co. Includes a look at the AI competition between the US and China.

https://www.hoover.org/research/schmidt-happens

Investing in Operating Systems: Alex Rampell

A great podcast interview with a deep discussion of Fintech and “operating system” business models. Toast (TOST) is prominently discussed throughout and is a case study for emerging operating system businesses.

Tech and Consumer Growth Investing with Gavin Baker

A far-ranging conversation about investing in the technology industry with Gavin Baker, a former Fidelity portfolio manager who is now CIO of Atreides Management. The interview digs into several important emerging tech trends.

A Great NFT cartoon:

**

A Selection of Recent Tweets from @RagingVentures:

Having managed money for a long time through many cycles, a few thoughts on how to stay mentally fit when things are tough (as they are now):

— If you’re not sleeping well, or are overly fixated on a position, reduce your exposure(s) so you regain your composure and sanity. 1/6

— Raging Capital Ventures (@RagingVentures) January 22, 2022

Clearly, $GLBE enjoys the pixie dust of Shopify, Abdiel and Spruce House, but paying $10 b+ for a biz w/ $300 mm of (slowing) run-rate revenues at sub-40% gross margins (due to massive fulfillment pass-thru costs) seems crazy. But what do I know!

— Raging Capital Ventures (@RagingVentures) December 1, 2021

$MTTR has a great vision, but paying ~$8 billion for an est $60 mm of ‘21 subscription revs (out of total est revs of $109 mm) is bonkers. Sub revenues have only been growing ~$1-2 mm per quarter (sequentially), in a booming RE market. Watch out for the late Jan lock-up expiry’s.

— Raging Capital Ventures (@RagingVentures) December 9, 2021

Buying some $PINS below $33. I like their position in "visual search" and am impressed with their product innovation. My wife and daughter regularly use the product. Monetization is still in the early innings, but the path is clear. $PYPL & $MSFT both saw value at $60+.

— Raging Capital Ventures (@RagingVentures) January 4, 2022

$APO completed its merger with Athene, along with other governance changes. It is now eligible for inclusion in the S&P 500. While no longer screaming cheap, $APO has a compelling biz plan and a track record of creating value. I own it for the long-term.https://t.co/9AJYy4Xk9O

— Raging Capital Ventures (@RagingVentures) January 3, 2022

$AAON is another one of those sleepy names (a la $MSEX or $MTD or $WDFC or $SLP, which we’ve talked about in the past on short side) that continues to defy gravity: an unexceptional HVAC maker at 50x+ earnings with mediocre mgmt and growth trends. Up 25% ytd and 4x since ‘16.

— Raging Capital Ventures (@RagingVentures) December 9, 2021

Great to see IsZo taking up this battle over defunct shorts with the prime brokers (Thank you, Brian!). Raging Capital has had similar issues with BTIG / GSCO. Hopefully, the prime brokers proactively take positive steps to resolve this issue. https://t.co/zHYUU9rwsW

— Raging Capital Ventures (@RagingVentures) December 9, 2021

Biggest insider buy in $AMBC since 2017. I’ve spent time with Claude LeBlanc the CEO; he is not an aggressive risk taker. Seems like a pretty positive vote of confidence ahead of court hearing on RMBS trial on 23rd and ongoing settlement of Puerto Rico matters.

— Raging Capital Ventures (@RagingVentures) November 12, 2021

**

Fortuna Audaces Iuvat – Fortune Favors the Bold!