Friends,

I am excited to interview George Gilder for this issue of “An Entrepreneur’s Perspective”.

I first became a follower of George by reading his Gilder Technology Report, a leading newsletter about technology investing in the 1990s and early 2000s. In addition to his amazing prose and vocabulary, George had a knack for seeing the future of technology. His newsletter, as well as his books like Life After Television, which he wrote in 1994, literally predicted the development of the Internet and the success of companies like Qualcomm.

I first met George in the late ’90s at one of his annual Telecosm conferences at Lake Tahoe, which always included a who’s who of visionary thinkers like Ray Kurzweil, Carver Mead, Andy Kessler, and many more. In 2002, George invited me to speak on a panel at one of his conferences. A young Larry Page was also presenting at the same conference; somehow, as he was not yet famous, I was lucky enough to score a one-on-one lunch with Larry! Unforgettably, in his presentation, Larry demonstrated how he could duplicate Walmart’s entire IT infrastructure, which Walmart was spending hundreds of millions of dollars per year on at the time, for just $500,000 using open source software and cheap x86 servers. In essence, at George’s conference, Larry shared the foundational blueprint for Google’s success over the next decade.

George’s influence on me didn’t stop there, though. Shortly thereafter, while on a first date in 2002 with my now wife of 17 years, Geniva, I mentioned that I was planning to attend George Gilder’s upcoming conference. THE George Gilder, she asked? As it turns out, George was also a legend in my wife’s household for the books that he had written in the 1970s and 1980s like Sexual Suicide, Men & Marriage (a must-read), and Wealth and Poverty. Geniva later joined me at that conference (for our second date!) and the rest is history…!

In my mind, George is one of the great technology and moral thinkers of the last 50 years. It is worth reading anything that he writes, but I would most recommend Life After Television, Wealth and Poverty, Men and Marriage, Knowledge and Power, and Life after Google. The Israel Test, which fuses George’s moral and capitalist/technology views, is another great book.

I would also be sure to read the following interview, which covers a wide-range of topics such as Life After Silicon, AI, Blockchain, China, and American Families. As usual, George is no shrinking violet – many of his views contrast with the prevailing consensus. Thank you so much for everything over the years, George. Enjoy!

I very much welcome your feedback and ideas. Please feel free to drop me a line. To subscribe to this newsletter (it is free), please click here.

Best Regards,

William C. Martin

Topics in this Issue of An Entrepreneur’s Perspective:

- Interview: George Gilder on Life After Silicon

- Idea Brunch Interview and Investment Ideas with Bill Martin

- Favorite Books & Media

- Recent Tweets from @RagingVentures

Interview: George Gilder on Life After Silicon (as well as his thoughts on AI, Blockchain, China, and American Families)

To start, maybe you could tell us about your latest (short) book, Gaming AI: Why AI Can’t Think but Can Transform Jobs.

Gaming AI debunks the argument that by beating humans in games—chess, Go and video games—Artificial Intelligence exhibits human capabilities. Games are symbol systems. Digital machines can shuffle symbols with algorithms running at billions of cycles a second. But as mathematician-philosopher C.S. Peirce proved way back in the 1920s, Alan Turing proved again in the 1940s, and John Searle proved again in the 1990s, symbol shuffling has little or nothing to do with intelligence or meaning. There is no obvious link between symbols and objects, maps and territories. They are linked only by a mediating intelligence, a human mind, what Turing called an “oracle,” which “cannot be a machine.” In games, in software programs, and in mathematics, the symbols are the territory.

In Gaming AI, I show that measured by density of interconnections, the connectome of the human brain is as complex as the connectome of the entire global internet. Both take a few zettabytes (10 to the 21) to map. But the brain runs on 12 to 14 watts of energy while the global Internet requires gigawatts. But only the brain actually knows anything or can generate information as entropy or surprise.

I also argue that the so-called quantum computer is really just another form of analog device. Analog is theoretically better than digital until you actually try to use it. Analog moves all the complexity to input-output (I-O). Analog machines like quantum computers are thus inherently special purpose devices, dominated by data-prep and sensor interpretation.

You’ve been an early and outspoken proponent of the blockchain and articulated many of the founding underpinnings of Web 3.0 (as featured in your book Life After Google), including the idea of decentralized social networks and new ways of organizing the traditional data center. Along these lines, what are you most excited about today?

Blockchains and related distributed ledgers are what Daniel Patrick Moynihan used to call a unity. They solve two key problems at once. Today blockchains offer the solution to the two crucial hacking crises in the global economy—the hacking of internet data by bezzles and spies and the hacking of global money by masked gangs of central bankers. By providing an immutable ground state and basis of factuality, blockchains address both the porous pyramid of the Internet and the Ponzi monies of central banks. Within a decade, all money will be on the blockchain. Let’s hope it will not be Chinese.

You’ve been a contrarian bull on China, arguing in favor of their entrepreneurial development and capitalistic instincts. I would love to hear your latest thoughts on this controversial subject.

The Trump Administration, followed by Biden, adopted a cold war posture toward China, brandishing our vulnerable aircraft carriers in the South China seas and Taiwan straits while accusing the Chinese of “aggression.” Our supposed goal of “decoupling” the two economies will benefit only communists and militarists in both countries.

China had adopted U.S. standards, business principles, chip technologies, operating systems, network protocols, wireless architectures, software languages, and entrepreneurial cultures. Can’t have that! By depriving China of chips made in Taiwan with some US intellectual property that is globally available, we are disrupting the supply chains that sustain US tech companies. By our economic nationalism, we are ripping the fabric of a worldwide digital infrastructure. Forcing China to develop their own systems and architectures, we are losing access to the worlds largest and most pullulating economy.

China has millions more engineers than we do, hundreds of thousands more startups, IQs some 7 points higher on average, and schools and universities focused on real science and technology rather than on bogus climate and COVID superstitions. From blockchains and artificial intelligence to manufacturing and chemistry, China now leads in most technologies and will soon be dominant in virtually all.

Trying to revive the cold war, the US is spurring the worst instincts in China while crippling our economy with a self-destructive mercantilism and “sustainability cult.” Our government is no longer less interventionist in the US economy than the CCP is in the Chinese economy. Believe it or not, as a share of GDP, Chinese government spending is about 70 percent less than ours and its fiscal policies are far more conservative. We had better change our delusional mentality or we are doomed to a long slog of increasingly poisonous politics and perilous economic and intellectual decline.

Looking back, your calls on the future of the Internet (Life After TV, Telecosm) and on companies like Qualcomm were prescient. What technology trends and companies are of most interest to you today?

I believe that we are entering “life after silicon.” We are creating a new carbon economy based on such materials as carbon nanotubes, graphene, buckyballs and carbides that enable a newly abundant and oracular connectivity with real world objects. Crucial to this “Internet of Things” is the development of blockchains that can render it secure. We also need wireless connections beyond the cumbersome and klugey constraints of 5G government standards. Engineering creativity is currently migrating away from 5G and its nationalized technologies and toward WiFi 6 and open source wireless RAN (radio access networks). Nothing is so futile and counterproductive as the climate change moloch, to which we are sacrificing our power grid, our agricultural land, our energy independence, and our childrens’ futures.

My choice for the cryptocosm is BitcoinSV (Satoshi Vision) which recently far eclipsed the prevailing BTC in transactions. The product of the real Satoshi Craig Wright, BSV is devoted not to speculative HODLing but to accommodating an efflorescence of new functions and transactions, including micropayments and investment platforms.

Before you moved into tech in the 1990s, you were an author of very important books like Wealth and Poverty and Men & Marriage. In my mind, the breakdown of the American family unit and the soaring rates of out of wedlock births are very concerning and one of our country’s primary challenges. I would love to hear how you think about some of these important issues today.

With the Biden administration, elected by a large majority of women in the face of massive male support for Trump, we are experiencing the climax of the matriarchal trends I depicted in Men and Marriage. I pointed out that while female roles are largely determined by biology, male roles must be invented. The enabling invention of human civilization is the male role as provider and protector for women and children. Destroy this role and you debauch civilization itself. At a time when some 25 percent of black children were born without fathers in the home, I predicted the resulting crime and demoralization in the inner city. Now 25 percent of all children are born without fathers present, and the demoralization and crime spreads across the economy. Feminism came first to the colleges and universities and largely disabled them. Men fled education and now are a shrivelled minority of 38 percent of graduates. Feminism has now moved into government and is disabling our bureaucracies, corporations, and even military. A feminized society cannot defend itself or advance technology or grow its economy. It’s “sexual suicide” on all sides.

Before we finish, tell us a bit about your upcoming conference COSM in Seattle. How do folks sign up to attend?

At my COSM conference November 10-12, 2021 in Bellevue, WA (see, COSM.technology), which will be keynoted by Peter Thiel, Kai-Fu Lee, Ari Emanuel, Bob Metcalfe, Carver Mead, and Mark Mills, I will debate Newt Gingrich on the desirability of cold war with China and Niall Ferguson on COVID. It should be a gas that illuminates the night. All are welcome to come.

Thanks so much, George. Good luck!

Sunday’s Idea Brunch: Interview with Bill Martin of Raging Capital Ventures

I was recently interviewed by the Bear Cave’s Edwin Dorsey for the inaugural issue of his new “Sunday’s Idea Brunch” newsletter, which features a weekly interview with underfollowed investors and emerging managers. You can sign up for a trial to the newsletter here: https://ideabrunch.substack.com/p/idea-brunch-with-bill-martin-of-raging

Edwin was kind enough to let us excerpt a few of the highlights of the interview. Enjoy!

“Bill, you are unique in that you’ve both started successful companies as an entrepreneur and backed many as an investor. What are the necessary ingredients for a winning investment?

Great question, although I wish starting and backing winners were as easy as following a recipe!

A few key ingredients do come to mind, though, including:

Betting on Entrepreneurial Owners. Albeit not a pre-requisite for all great investments, I can’t overstate the importance of having a corporate culture of entrepreneurial ownership. This occurs when management and employees have real skin-in-the-game and are also empowered to build and innovate. It is this creativity, invention, and attention-to-detail that builds great companies. Hired caretakers can go through the motions, but it is not the same. Partnering with great founders and CEOs who have this mindset can change your investment life. Just as notably, it is much harder to short these types of operators!

Is Business Getting Harder or Easier? A simple but important part of my framework is evaluating the factors that are creating tailwinds or headwinds for a company. For example, I ask questions like “Is TAM growing or shrinking; where is the company in its product cycle; what are the relevant competitive dynamics; is cost of capital rising or falling, etc.” You can use this mindset to think about both longs and shorts over various timeframes. Obviously, it is better to go long when a stock is cheap and things are getting easier, or to short when a stock is expensive and things are getting harder.

Protect your downside. The best laid plans can and do go awry. Markets go up and down; not even Jay Powell can permanently suspend that cyclical reality. Limiting downside through margin of safety and avoiding zeros is necessary for investment survival, even if it is not sexy during bull markets. Although it is inherently riskier, I try to approach venture investing like this as well, as I don’t have the luxury to regularly “swing and miss” like some bigtime VCs.

Staying Power through Conviction. A winning investment requires grit, persistence and patience. It is not easy to wait for the right pitch or the right price, nor is it easy to sit tight as the business evolves over time in the face of both opportunities and challenges. You need to “own” your ideas from the inside-out in order to have the proper conviction to know when to buy and sell and to successfully navigate the inevitable ups and downs.

What are two or three interesting ideas on your radar now?

Liberty Sirius (LSXMA): LSXMA trades at an approximately -25% discount to the value of its stakes in Sirius XM (SIRI) and LiveNation (LVY). I believe that discount will narrow as LSXMA is poised to imminently control 80% of SIRI, which will allow it to tax efficiently dividend cash flows from SIRI to LSXMA. This should enable LSXMA to turbo-charge its buyback; ultimately the two entities will likely collapse into one, fully eliminating the discount. Importantly, since it is largely excluded from the indexes, SIRI itself is an inexpensive stock, trading at north of a 7% free cash flow yield and growing nicely. Thus, via LSXMA, you’re effectively buying SIRI at a dirt cheap 10% free cash flow yield!

Five Point Holdings (FPH): A large California land developer that was spun out of Lennar (LEN) in 2017 via an IPO at $14 per share, FPH has been ignored by investors due to its past long development cycles and lumpy cash flows. Now, with the stock around $8, FPH is finally at an inflection point as its 15,000-acre Valencia project in Los Angeles County (which took 20 years to permit and develop!) is finally selling homes. Additionally, FPH’s Great Park community is now mature and cash flowing, while there are signs that the company’s Candlestick Park project may finally start to move forward. Importantly, the balance sheet is rock solid. Recent management changes, plus plans for an investor day, should also help to catalyze the stock.

Exterran (EXTN): In the speculative camp, EXTN has multi-bagger potential as its markets recover from the energy bust and it transitions to a more capital-light business model. Specifically, EXTN could secure an “offtake” partnership with an infrastructure investor with a low cost-of-capital who desires the company’s water solution deals for ESG reasons. This would enable EXTN to convert a portion of its business to more of an origination and servicing model, freeing up cash flow and accelerating de-leveraging. Sam Zell owns 25% of the company and has strong influence on the board; he also bought more stock in Q2 at around these levels.”

Favorite Books & Media:

George Gilder on Knowledge, Power, and the Economy – December 2013

George discusses his book Knowledge and Power, outlining his Information Theory of Capitalism. He argues that “wealth is knowledge, growth is learning, and money is time.” Gilder also emphasizes how “highly unpredictable discovery” is dependent on stable, “low surprise” carriers of law & order, property, and money.

George Gilder and Craig Wright Fireside Chat at CoinGeek – London 2020

George digs into the benefits of the blockchain in a fireside chat alongside Craig Wright, who George believes is Satoshi Nakamoto. An interesting back-and-forth on a number of timely issues around money, governance, and discovery.

Jay Hoag, TCV – Calibrating Market Adoption

TCV’s Jay Hoag talks with Patrick O’Shaughnessy about his amazing career as a venture capitalist and crossover investor, including the defining attributes of successful companies like AirBnB, Netflix, Peleton, and many others. Most interestingly, he discusses why he looks for “slightly crazy” founders and how he judges investment potential over very long timeframes. A great interview.

https://www.joincolossus.com/episodes/80028950/hoag-calibrating-market-adoption?tab=blocks

Venture Unlocked: Semil Shah on the state of VC today

Lots of great nuggets in this interview about how challenging it is to enter venture capital, how Shah’s approach has evolved, and his thoughts on the current state of the industry today.

https://ventureunlocked.substack.com/p/haystacks-semil-shah-on-building

Coming Apart: The Status of White America, 1960-2010 by Charles Murray

Coming Apart explores the rise of the “new upper class” in America which is defined, not by race or ethnicity or even politics, but rather by education (75% of the highest IQs go to just 105 schools) and income. This new upper class increasingly lives among themselves in a select group of “SuperZips” (a handful of exclusive zipcodes) around the country, with their own *culture* that is increasingly distant from Main Street.

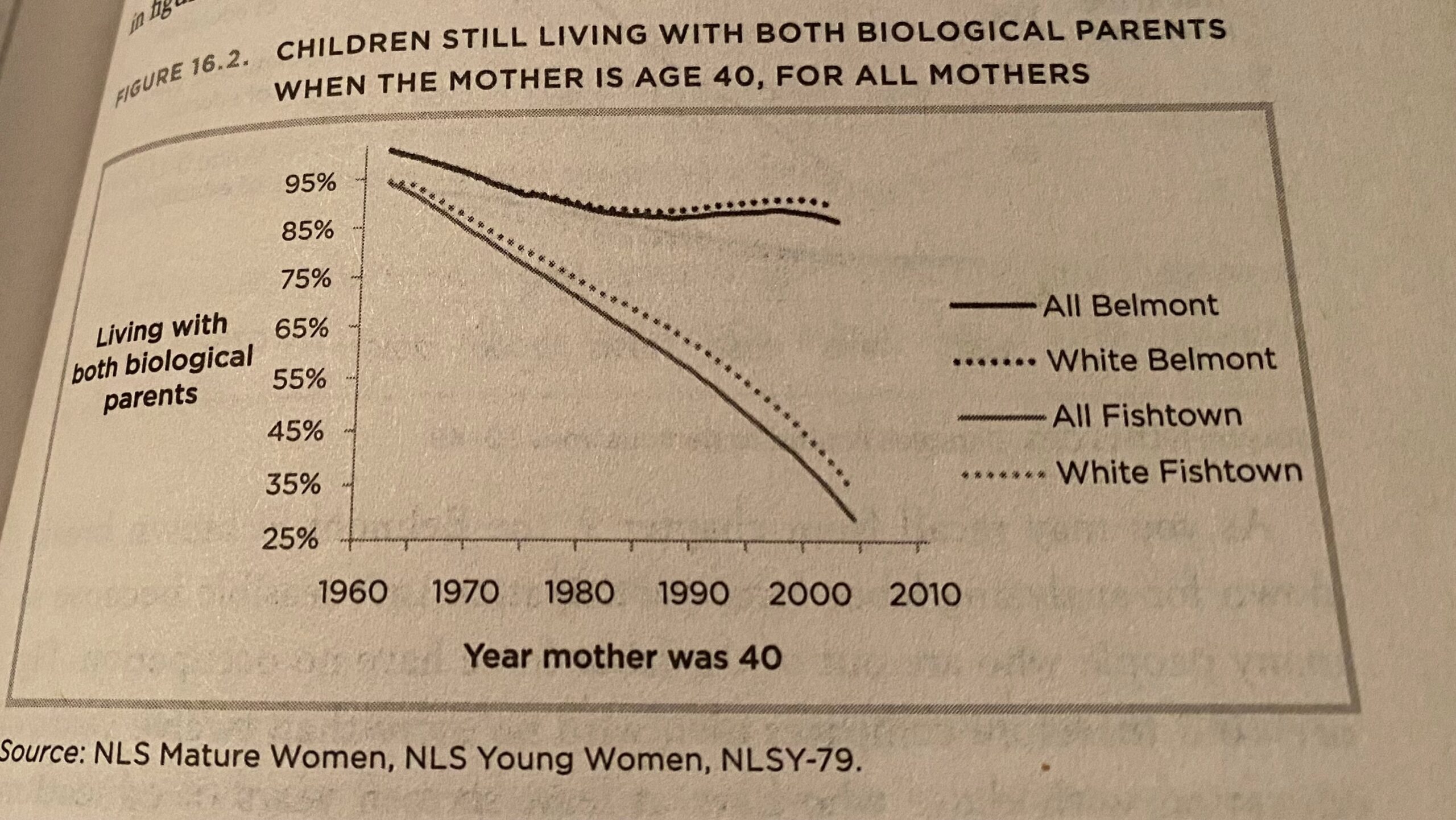

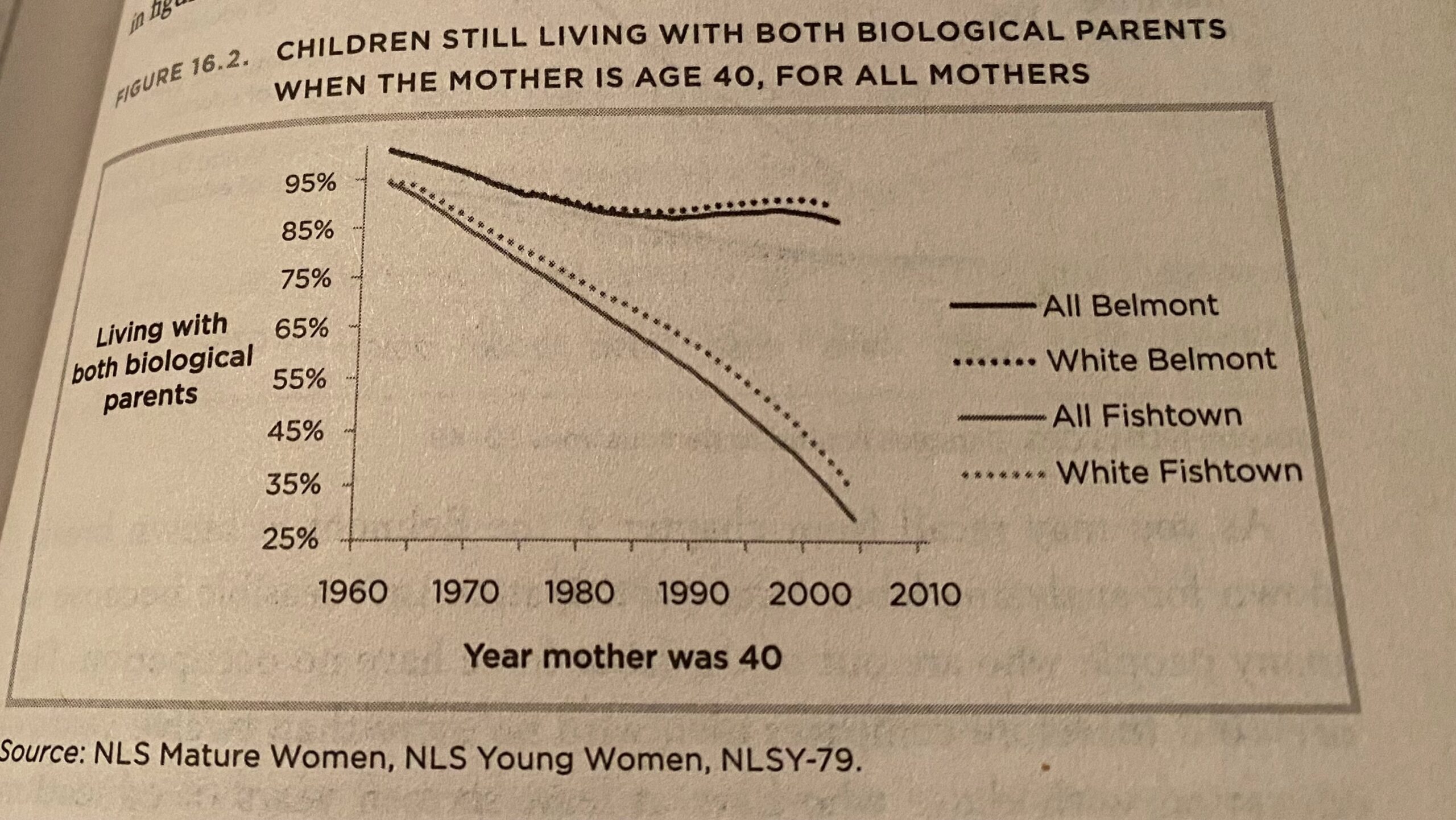

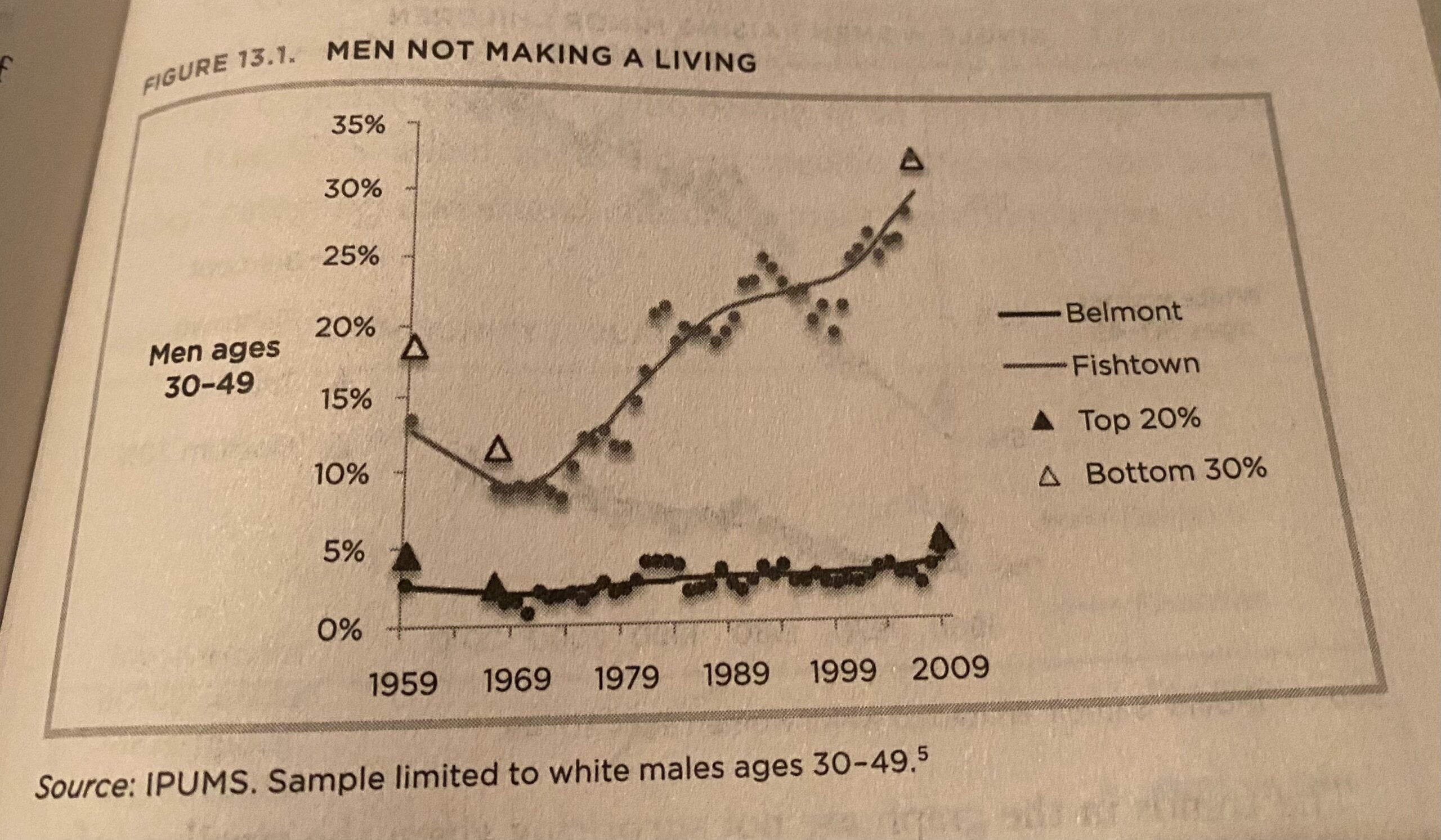

In contrast, Murray shows how many traditional working-class communities (actual data is referred to as “Fishtown” below; “Belmont” is a representation of upper class communities) are seeing declining rates of labor force participation, church attendance, and marital commitments, while poverty, crime, and broken family units proliferate. These are some of the same points that George Gilder discusses in the interview above.

Marriage for All Prime-Age Adults

Children Still Living With Both Biological Parents when Mother is Age 40

Men Not Making a Living

A powerful and important book that is full of facts and figures, but also quick and easy to read.

**

A Selection of Recent Tweets from @RagingVentures:

Hoping at least Stan’s golf shoes can rub off on me… pic.twitter.com/YdfPoTc9vu

— Raging Capital Ventures (@RagingVentures) October 13, 2021

1/3. Vivid Seats $SEAT (currently $HZAC) is one of a handful of overlooked SPACs that are attractive; it is due to start trading Oct 19th. One of the largest ticket resellers, $SEAT has a $2b EV, little pro-forma debt, and trades for just ~16.5x '19 EBITDA (17.7x '22E). pic.twitter.com/ZD6D0tV13U

— Raging Capital Ventures (@RagingVentures) October 11, 2021

The GDP of West Virginia is only $80 billion, yet Joe Manchin controls the fate of trillions. I'm sure West Virginia is going to end up with the nicest roads in the country, among other goodies. How do you invest in this? A WV Opportunity Zone?

— Raging Capital Ventures (@RagingVentures) October 1, 2021

$XLNX trading at a 14%+ discount to the value of $AMD's acquisition offer (1.7234 AMD shares). Deal awaits Chinese approval. One would think that perhaps there was a quid pro quo when Huawei CFO Meng Wanzhou was released last week?

— Raging Capital Ventures (@RagingVentures) October 1, 2021

Congrats @ToastTab! https://t.co/qdVCQaOauO

— Raging Capital Ventures (@RagingVentures) September 22, 2021

**

Fortuna Audaces Iuvat – Fortune Favors the Bold!