February 4th, 2025

Friends,

I am very excited to share the edited excerpts of my Ideas & Networking Conference fireside chat with Brian Bellinger, the Founder and CIO of Monimus Capital. Monimus is a long/short investment firm that has an opportunistic, value-oriented investment strategy and a distinct approach to short selling. Brian and I previously worked together for many years at Raging Capital where he was a Managing Partner and oversaw key aspects of our long and short books.

Brian is a unique and talented investor that has graduated to being a successful portfolio manager with excellent risk management skills. He is able to see the big picture, while also digging deep on a very granular basis into company analysis, diligence, and accounting. My family and I sleep well at night with Brian managing a healthy portion of our capital.

Our discussion looks back at some of our greatest hits at Raging Capital, including shorts in Insys Therapeutics, Valeant, and Conn’s. Brian also makes the case for his diversified approach to short selling, highlighting that over 2/3rds of Russell 3000 stocks underperform over the long term. He also pitches a long idea!

I am confident you will find value in this interview. Enjoy.

Best Regards,

William C. Martin

Topics in this Issue of An Entrepreneur’s Perspective:

- Interview with Brian Bellinger: The Case for Short Selling

- Favorite Podcasts & Media

- Recent Tweets from @RagingVentures

**

Interview with Brian Bellinger, Founder & CIO, Monimus Capital: The Case for Short Selling

This fireside chat originally occurred on September 19, 2024. ChatGPT was used to format and lightly edit the original discussion, using a “formal conversation” prompt.

So how does a hockey player from Upstate New York end up in the hedge fund world?

I didn’t exactly take the traditional route to becoming a fund manager — though, maybe not quite as unconventional as yours! I grew up just outside Syracuse, in upstate New York, in a pretty modest household. My parents weren’t in finance, but I caught the investing bug in sixth grade. We had a stock-picking game in my math class, and I was hooked. I was always curious, so learning about businesses and tracking stocks was exciting for me. I’d check stock quotes every morning in the newspaper—if anyone remembers those! This was around early 1999, so it was an exciting time; you’d pick a stock, and it could jump 100% in a few weeks. By middle school, I knew I wanted to be a fund manager.

You joined Raging Capital in 2012. What was it like coming into the fund as a junior analyst? Could you share some insights about that experience, including both the pros and cons? Feel free to be candid.

Absolutely. I graduated in 2009 and had hoped to secure a position at a fund right out of college. However, interviewing during the fall of 2008 was not the ideal situation for landing a finance job. As a result, I spent about three years in public accounting, networked, and eventually joined Raging in the summer of 2012. The experience felt like drinking from a fire hose, especially during those first couple of years.

What really stood out to me at Raging were a few key aspects that facilitated my growth as an analyst and prepared me for my current role. First, the significant autonomy you provided was incredibly beneficial. Many managers tend to adopt a top-down approach, directing analysts on precisely what to research. In contrast, you allowed me the freedom to pursue my own ideas while still giving me tasks to work on. That independence was instrumental in my development.

Second, the firm’s contrarian mindset proved to be invaluable. Working out of a renovated church in a small town in New Jersey offered a different perspective compared to the typical hedge fund environment on Park Avenue. This unique setting shaped my worldview significantly. Additionally, the firm’s strong emphasis on short selling was a core part of my experience.

I apologize if I inadvertently infected you with the short selling bug.

Not at all! It was essential to my development. The majority of my time at Raging was focused on the short side, and I believe that having the perspective of a short seller ultimately makes you a better long investor as well. We certainly had our share of ups and downs in that area, but it was an invaluable part of my learning process.

Do you have a favorite short or two from your time at Raging that you’d like to discuss?

Absolutely. One that stands out is Insys Therapeutics. Some in the room may be familiar with it. I’m not sure if it was our top contributor on the short side, but it certainly ranked among the best during our time at Raging. Insys was a single-product drug company that received FDA approval for an oral spray of fentanyl. As many know, fentanyl is a significant issue in the U.S. right now. It’s 100 times more powerful than morphine, originally intended for terminal cancer patients who required relief from severe pain.

However, based on our research, Insys shifted its marketing focus to pain clinics and unscrupulous doctors. In fact, less than 10% of their sales were for the intended use. We tracked the payments made to doctors promoting their products, and we discovered that many of these doctors had questionable backgrounds — some had been reprimanded or had even lost their medical licenses.

So, they were essentially operating as publicly traded drug dealers.

Precisely. At one point, they had a multi-billion dollar valuation. We identified these issues in 2015 and 2016, but it wasn’t until 2019 that the company ultimately went bankrupt, and most of the management team ended up in prison. It serves as a reminder of how slowly the wheels of justice can move; we recognized the problems years before they came to light.

Another noteworthy aspect of the Insys case was the importance of maintaining a short position, even when it moves against you. The company was very promotional and kept introducing new ideas, even exploring cannabis-based drugs and other products. During the time we were shorting the stock, it increased by 40% or more on about seven different occasions. Each of those spikes provided us with opportunities to add to our short position as it ultimately moved toward zero.

On the long side, investors like to “collect” compounders and great businesses, always wishing they could own them at the right price. In contrast, short sellers tend to “collect” struggling companies that often can be shorted multiple times. Let’s discuss Conn’s — another one that just went bankrupt and that we shorted repeatedly. It just never seemed to die, did it?

That’s right. For those who aren’t familiar, Conn’s is a fascinating case. I started looking into Conn’s in late 2012, and we’ve been shorting it on and off between my previous firm and my current one for over a decade now.

It had a fitting name, for sure.

Conn’s is a subprime retailer based in Texas, with most of their stores located there and in the Southeast. They had a unique business model where they not only sold merchandise but also financed purchases directly on their balance sheet. Typically, in the industry, the financing would be handled by a third party. This approach allowed them to show impressive growth at times because they were approving anyone for financing. However, they ultimately faced significant credit issues. While it boosted their short-term results, we recognized the underlying problems.

The company went through several management changes, all while replaying the same strategy. At various points, the stock received a high growth valuation, but we understood where it was ultimately headed. Recently, Conn’s declared bankruptcy, after securing a near-term lifeline from B. Riley, which didn’t pan out.

Can you discuss Valeant and highlight, like Conn’s, how you can make more than 100% on a short?

Valeant was certainly front-page news for a significant period, and we weren’t the first short sellers to get involved. The stock peaked at over $300 per share, and our initial cost basis was around $150. We had conducted extensive research to substantiate the short case, and as the stock began to decline, we amassed a wealth of data demonstrating that the underlying business was crumbling. I don’t have the time to dive into all the specifics now, but we managed to piece together some really compelling data sources. We added to our short positions at $90, $60, and $40.

I believe there’s a quote, possibly from David Einhorn, that fits Valeant well: “What do you call a stock that’s down 90%?” It’s a stock that’s down 80% and then gets cut in half!

A few years ago, you launched Monimus Capital with a couple of other Raging Capital alumni. Can you talk to us about Monimus?

We launched Monimus in late 2020, during what was undoubtedly a tumultuous year for all of us. Throughout that time, I helped wind down the Raging Capital fund and simultaneously set up what became Monimus. Remarkably, we raised capital without a single in-person meeting; everything was conducted over Zoom, all from my apartment, and we officially launched in September 2020. We just celebrated our four-year anniversary.

In terms of our investment approach, we consider ourselves opportunistic, value-oriented investors. On the long side, we look for companies that are misunderstood, overlooked, or underappreciated.

On the short side, we employ a strategy that I think is quite unique. Our core short book consists of traditional single-idea, catalyst-driven shorts, which make up the majority of our short positions. The remainder includes diversified baskets of companies that we believe, using a process that we’ve developed and refined over the last decade, are suspected frauds, stock promotions, exceedingly low-quality businesses, or some combination thereof.

I must say, Brian you are much better at managing risk than I ever was and a great investor overall. Your returns have been impressive. Could you share what your typical net and gross exposures look like, and where the attribution for those returns has come from?

In terms of gross exposure, we generally aim for an average of around 150%. Since inception, we’ve averaged just below that, and our net exposure typically runs between 30% and 50%. I acknowledge that our gross exposure is on the lower end compared to what you might see with other long-short hedge funds, but we believe that, given our strategy — especially since beta on the short side tends to be higher — this level of exposure is optimal for us. It allows us to maintain dry powder for challenging times.

There have been numerous instances where having excessive gross exposure can lead to difficulties, such as having to cover shorts at inopportune moments or selling longs to manage down gross exposure while experiencing losses. We strive to keep dry powder so we can be opportunistic and proactive during those periods.

Regarding attribution, I’m somewhat limited in what I can disclose due to SEC regulations. However, I can share that since we launched our fund in 2021, we’ve made profits on the short side every year—2021, 2022, 2023, and year-to-date through August of this year. Shorts have accounted for a significant portion of our gross and net returns since inception, which I think is quite unique. Our objective with shorts is also distinct; we aim to generate returns from our short positions over the long term. While many funds use shorts to increase leverage, hedge their books, or dampen beta, we view them as a complementary source of returns for our long book.

You’re also an excellent long investor. Can you talk about how you structure your long book?

Absolutely. As I mentioned earlier, we take a value-oriented approach, but we’re fairly agnostic when it comes to the growth versus value spectrum — we’re open to opportunities across the board. We conceptualize our long book around four key pillars. Some of these might be familiar to you.

The first is off-the-beaten-path growth. We aim to identify companies that exhibit attractive growth profiles—both in revenue and earnings—yet are trading at value-like multiples. This has become our bread and butter. Typically, there’s been a temporary headwind affecting the business, the sector has fallen out of favor, or there’s a positive development that the market has yet to recognize.

The second pillar is deep value with a catalyst. This is a concept you’ll recall from our Raging days. As value investors, this approach is in our DNA. There are many cheap stocks out there, but we put a strong emphasis on finding those that have clear, definable catalysts. This has been a challenge for value investors over the past decade; while it’s relatively easy to identify cheap stocks, it’s considerably harder to find those that are trading at low multiples but also have a catalyst for improvement.

The third pillar is what we refer to as fallen angels. These are objectively excellent businesses that were once popular among funds but have experienced a shift — whether company-specific, industry-related, or factor-specific — that has caused a significant compression in their valuation multiples. In our experience, it’s more common than not that these businesses rebound and reclaim the premium valuations they once enjoyed. Our task is to differentiate between those that are genuinely excellent and those that have suffered permanent impairment.

Lastly, we also look for asymmetric special situations. This approach is highly opportunistic and serves as a complementary source of ideas for our long book. The number of names in this category can vary significantly—it could be zero or several. But we consider these four pillars important. They provide balance to our portfolio, especially since investment themes tend to go in and out of vogue. The proportion of our exposure to any of these pillars can fluctuate over time, which helps us maintain a diversified approach compared to many other strategies out there.

Is there an idea or two you would like to share?

I’d like to discuss a restaurant stock called Potbelly (NASDAQ: PBPB). You may find a few locations here in New York, and it has a national footprint that I believe most people have heard about. Potbelly went public about a decade ago, and I think we were short it (at Raging) at the time.

Which bucket does this fall into?

Potbelly falls primarily into off-the-beaten-path growth, but it could also be considered deep value with a catalyst to some extent. Currently, the stock is trading around $8, with a market cap of approximately $250 million. It’s a small-cap name and trades at about 8x EBITDA.

Potbelly has had an intriguing trajectory. Initially, it was a high-growth story upon going public in the mid-2010s, boasting an extreme valuation. However, the company encountered several challenges, particularly with site selection. The pandemic posed additional difficulties, especially since they had a significant urban presence where corporate lunch crowds represented a meaningful percentage of their sales.

On the positive side, Potbelly has brought in a new management team. The CEO previously served as the COO of Wendy’s, where he oversaw a significant transition to franchising. They also recruited a new CFO with experience at Panera and McDonald’s, creating a high-quality management team, particularly for a company of this size. They are now pursuing an aggressive plan to expand the business, primarily through franchising rather than company-owned stores.

Potbelly currently operates just over 400 locations and aims to reach 2,000 stores in the U.S. over the next decade. If they come even remotely close to that goal, the stock could increase severalfold. We’ve conducted extensive research on this opportunity, particularly regarding their new store prototype, which was rolled out recently.

Before the pandemic, digital sales accounted for a small percentage of their revenue, but now it’s over 40%. This shift allows for a smaller footprint for their stores, and they currently have limited exposure in suburban areas. The economics of a suburban-focused franchise model appear to be quite promising.

What does it cost to open a location, and what kind of ROI can franchisees expect?

Opening a franchise location typically requires several hundred thousand dollars in investment, but franchisees can achieve cash-on-cash returns of over 30%. These returns are competitive and, in some cases, exceed those of well-established fast-casual sandwich chains like Jimmy John’s and Jersey Mike’s, which are largely mature concepts. For instance, Potbelly has no presence in the Atlanta metro area, while there are many Jimmy John’s and Jersey Mike’s locations there. This represents a compelling opportunity for franchisees to enter that market and potentially develop 15 or 20 stores over the next few years. Additionally, given Potbelly’s current valuation, we like to look for situations that offer a “free call option” or optionality. At present, the market seems to dismiss the growth potential entirely, with the stock trading at around 8x EBITDA.

We look for two key benchmarks in restaurant investing: a market cap under $500 million and an EBITDA multiple of eight times or below. There are very few restaurant stocks that meet these criteria in the U.S. today because most have been acquired by private equity or strategic buyers. We believe that one of two outcomes is likely: either the company successfully executes its growth plan over the next several years, resulting in a higher stock valuation, or it becomes an acquisition target.

Can we dig into your “distinct approach” to short selling?

Short sellers often find themselves in a cyclical pattern. On one hand, they’re vilified when stocks decline significantly, and on the other, they face scorn during market highs, as we saw in 2020 and 2021, when many short-leaning shops were forced to shut down. There’s a common perception that short selling is somewhat of a lost art. However, in this room, we understand its value.

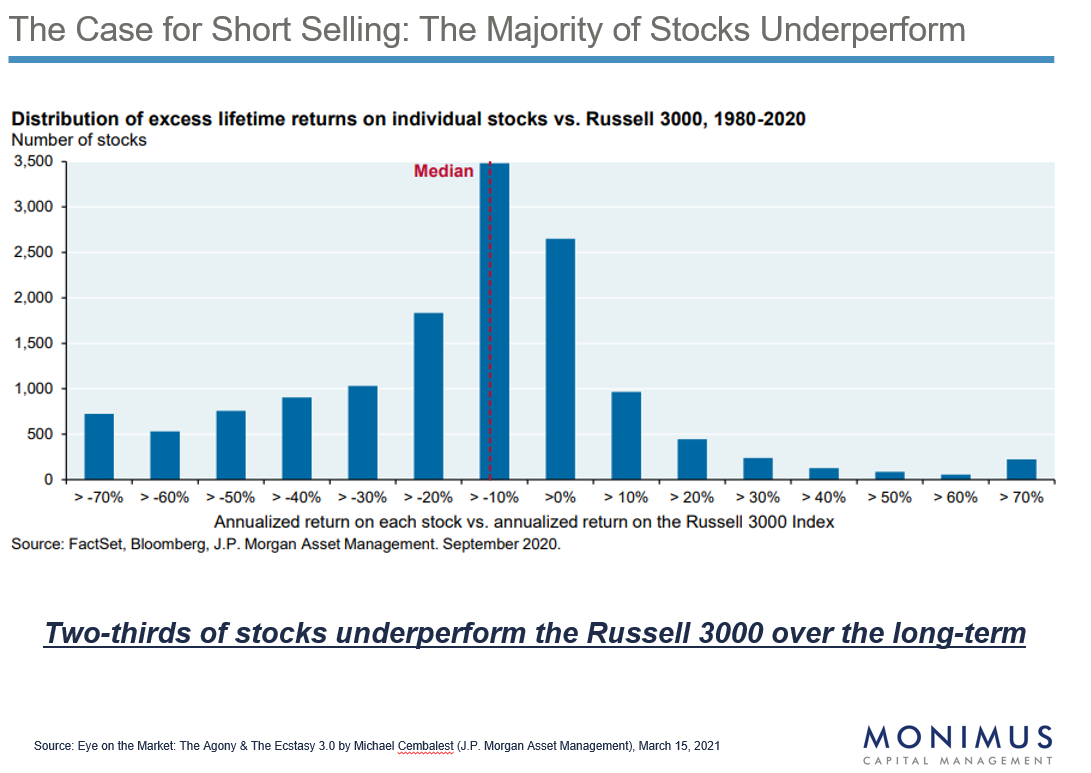

There are various sayings you often hear in the investment community, like “a stock can only go down 100%, but it can rise infinitely”, or “the stock market tends to go up over time, so why bother with short selling?” Yet, I wanted to share some statistics that underscore the opportunities in short selling. These insights are from a report by Michael Cembalest at JP Morgan, which he updates every decade in a publication titled “The Agony and the Ecstasy.”

What’s shown in the chart here is quite telling: over the past 30 years, approximately two-thirds of individual stocks have underperformed the Russell 3000 Index. Notably, most of the index’s performance can be attributed to a small group of extraordinary winners. We’ve seen this in the S&P 500 recently, where a handful of companies—the “Magnificent Seven”—accounted for a substantial portion of the index’s gains.

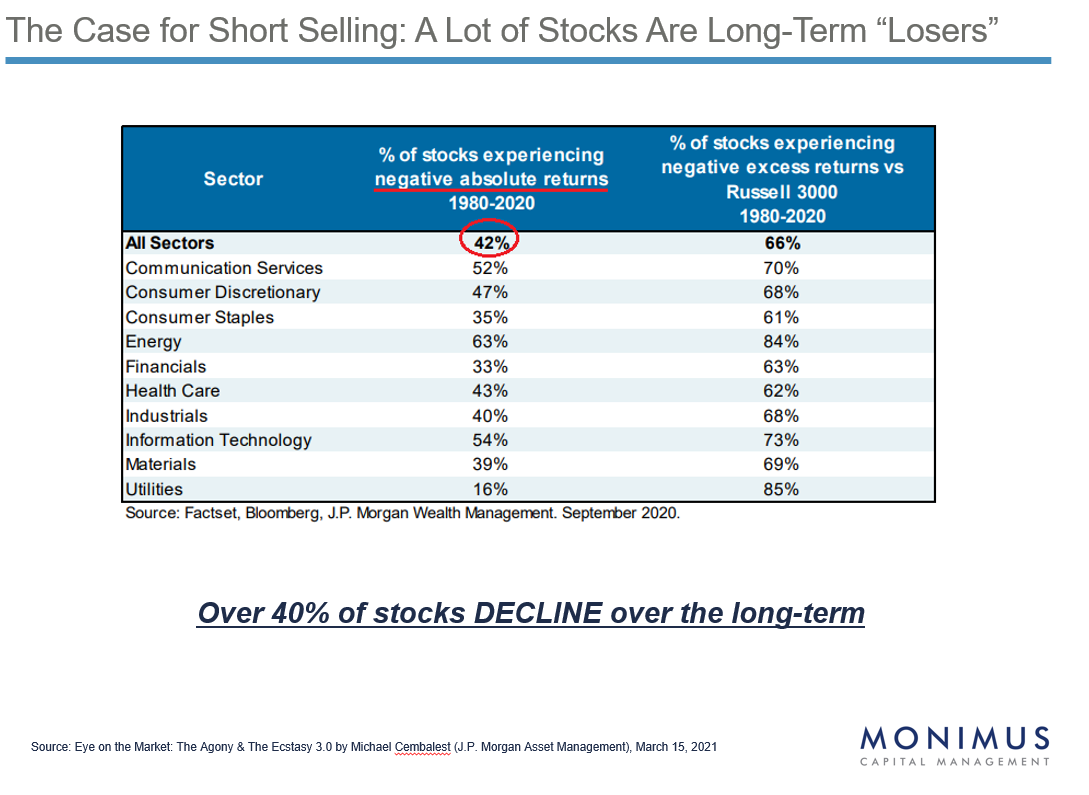

Interestingly, if we break this down by sector, we find that over 40% of stocks have negative returns during that same period. The sectors where we typically operate, such as consumer, technology and healthcare, experience more creative destruction, leading to a higher percentage of stocks that decline over the long term.

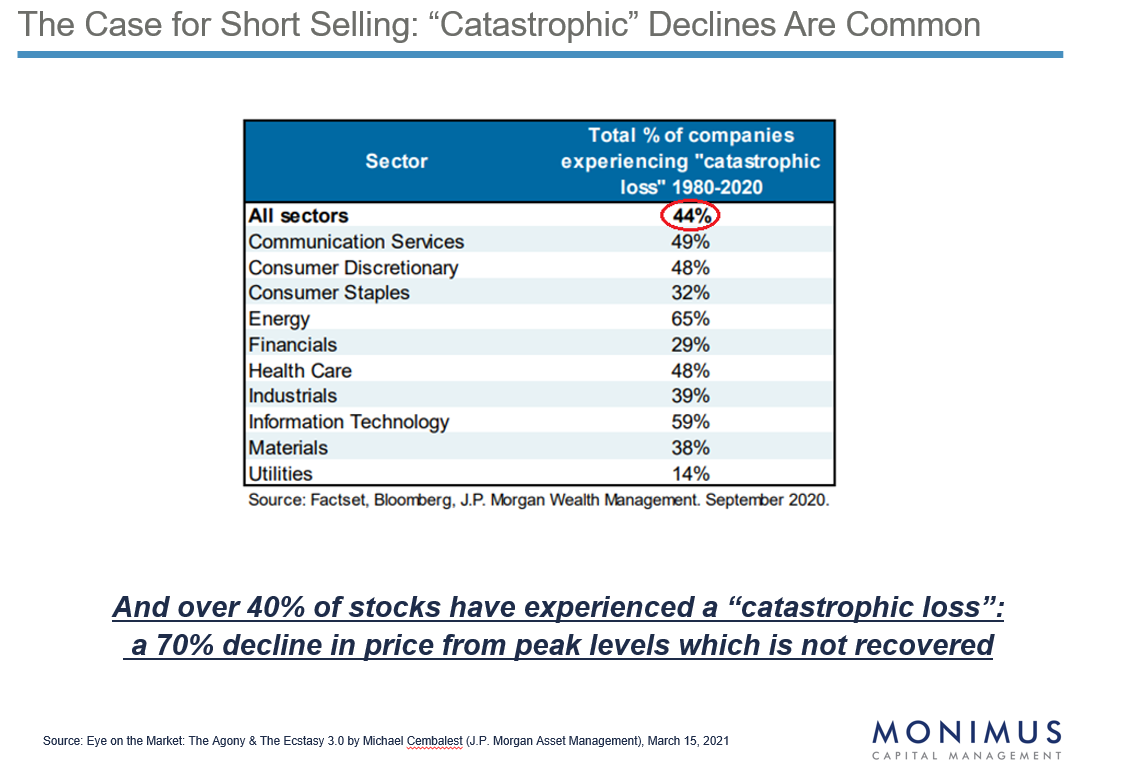

Furthermore, nearly 40% of stocks have experienced “catastrophic declines” — defined as drops of over 70% — that were never fully retraced. This indicates a significant opportunity on the short side. However, to capitalize on it, you need a thoughtful process to identify those underperformers and effective risk management is crucial. These long-term trends can be volatile, and shorts can be particularly painful during certain periods.

I see, so while you wouldn’t want to short Amazon, you could effectively target other e-commerce companies.

Exactly. Our approach to short selling is notably more diversified than that of most firms. As I mentioned earlier, about one-third of our short book consists of diversified baskets of shorts, with each individual short typically representing only 10 to 50 basis points of our portfolio. We maintain dozens of these positions. Moreover, it’s uncommon for us to have a short position exceeding 2% to 2.5% in our core book. This strategy allows us to have numerous opportunities — essentially, many shots on goal. Our focus is on leveraging our historical experience, rigorous research process, and pattern recognition skills to identify a greater number of underperformers over time, and our results have validated this approach.

Are there specific sectors where you’re currently finding a lot of short opportunities? And overall, are you more enthusiastic about your long positions or shorts these days?

To address the second part first, our net exposures are on the lower end compared to our historical average. We believe the opportunity set on the short side is quite robust right now. The market environment over the past two years has been particularly fascinating. We’ve observed a significant amount of dispersion, leading to intriguing opportunities on both sides of our portfolio.

This year, however, has been particularly notable due to extreme momentum in both directions. The winning stocks have experienced substantial gains, while the losing stocks have consistently trended downward. In such an environment, we must remain very focused on risk management, but it also presents a wealth of opportunities to capitalize on.

In your recent letter, you mentioned the increasing frequency of “100-year storms” in the markets. What do you think is driving this phenomenon?

I believe the structure of the market has fundamentally shifted over the past five years. As I noted in a recent letter, the pre-2020 playbook for running long-short funds is no longer entirely relevant. There are several factors at play today that have gained significant prominence. For instance, the retail investor has become much more influential, largely due to the rise of commission-free trading and the convenience of mobile trading apps.

Additionally, multi-manager funds have raised substantial amounts of capital and, in many segments of the market, they are now the marginal buyers and sellers. Their focus tends to be very short-term, which presents an opportunity for those of us who can adopt a longer time horizon.

There’s also the trend towards passive investing, which continues to attract more capital. Passive funds are, by their nature, price-insensitive buyers and sellers. This influx of larger pools of capital creates market distortions that we can strategically leverage. We’ve demonstrated our ability to capitalize on these changes over the past few years.

Guest Q&A: Brian, where do you originate a short idea? Is it similar to a whistleblower approach? I can’t imagine your analysts are combing through endless reports. How many shorts do you currently have in your book—70, 80, 60?

Today, we have somewhere between 100 and 120 short positions. However, there is quite a long tail on that.

And how many longs do you have?

We maintain about 30 to 35 (core) long positions.

So, how do you source your ideas?

Our process is twofold. First, regarding the baskets, we’ve developed a methodology that dates back to our time at Raging. We focus on identifying red flags for companies that exhibit concerning characteristics. This is rooted in our extensive history and experience. It can involve various factors, such as the track records of management and board members, the types of companies they’ve previously raised capital through, and their path to the public markets — whether through a reverse merger or a traditional IPO. We compile a list of companies that exhibit these characteristics and short a selection of them as part of our baskets.

For our core short book, the process is more organic. We heavily rely on our institutional knowledge and pattern recognition. Given our extensive experience, we pride ourselves on having a broad understanding of many companies. For instance, I maintain a watch list of around 700 companies, each of which we’ve researched to some extent over the past six to eight years. For example, when there’s a fundamental shift or when valuations become excessively high, we take those as cues to dive deeper into our analysis. This foundational knowledge allows us to quickly get up to speed when opportunities arise.

Guest Q&A: I really appreciate the discussion on short selling, Brian, and congratulations on your impressive results. Given the breadth of ideas you’re tracking, short selling typically demands a significant amount of effort. With the rise of AI and technology, have you integrated any of these tools into your process for identifying and conducting due diligence on your short ideas?

That’s an excellent question. However, I must admit my answer might be a bit underwhelming. The reality is that we haven’t embedded AI significantly into our process at this point. Short selling relies heavily on nuance, and while large language models and AI offer valuable tools for quickly building a foundational understanding of topics, we haven’t yet achieved the level of confidence needed to rely on them extensively in our research process. That said, I would be surprised if, in the next 18 to 24 months, we don’t see an evolution in how we incorporate these technologies into our workflow.

We do utilize tools like transcript summaries on platforms such as FactSet and AlphaSense, which are helpful for quickly grasping the landscape of a particular topic. However, that represents only a small fraction of our overall approach.

Any parting advice for young people seeking to get into the business?

Sure! I want to revisit something from the beginning of our conversation. I feel very fortunate to have the chance to fulfill my childhood dream. I noticed Bob Roberti in the audience — it’s a small world. I grew up in upstate New York and interned during college with one of the few hedge fund managers from that area, Mario Cibelli, who actually worked out of Bob’s office. It’s come full circle for me today.

For those in the audience, especially students or anyone looking to follow a similar path, my advice is to be persistent and network as much as you can. Even if your background isn’t traditional, if you are determined, intelligent, and eager to learn, the industry is smaller than you think. If you put in the effort, you can find yourself in a similar seat one day.

That’s fantastic advice. Thanks for all of your great insights! For anyone interested in more information on Monimus Capital, feel free to contact Brian Bellinger at brian@monimuscapital.com.

**

Favorite Books & Media

Tetragrammaton – Unexpected Conversation: Richard Feynman

My son and I were listening to this podcast, featuring a conversation between the music producer Rick Rubin and physicist Richard Reyman, on the way to school one day when a lightbulb in my head went off and I asked, “Wait, how old is Richard Feynman?” When I learned that he was born in 1918, I soon realized that this was an AI-generated podcast! While the discussion of quantum mechanics was over my head, even though Feynman is very approachable with his explanations, this was a believable conversation with lots of interesting nuggets about Feynman’s creative process, out-of-the-box ideas, and observations on the world of physics.

Hedgeye Real Conversations: Crystal Ball – Mike Taylor’s 2025 Market Predictions

I thought this was a super interesting discussion with a focus on everything going in Washington with DOGE, Musk, Trump and the budget. In Mike Taylor’s view, Trump is walking a very fine line as he tries to rein in government spending to keep the bond market from blowing up while also keeping the economic pump primed. Taylor is skeptical that Trump can pull it off, and is short consumer-orientated names such as Wal-Mart (NYSE: WMT) who are exposed to cuts in SNAP spending as well as the crackdown on illegal immigrants. Taylor runs the PINK ETF pro-bono, and previously had a background as a bio/pharma scientist and then as the Head of Healthcare at OppenheimerFunds.

Dwarkesh Podcast: The War for India

This podcast provided a greater primer on the unique attributes of India and a history of its geopolitical dealings, including with Mao, Soviet Russia, Pakistan, and the United States. While topical due to India’s current importance, this podcast is chock full of amazing history about the dealings of the U.S., China, and Soviets – and details much of the friction that has long existed between Russia and China. It also digs into the past geographical importance of Pakistan to the U.S., which has greatly complicated relations with India.

P.S. Part 2, “Why Japan Lost”, is also a good listen although with more of a focus on how much different the Japanese culture is from the U.S.: https://podcasts.apple.com/us/podcast/sarah-paine-episode-2-why-japan-lost-lecture-interview/id1516093381?i=1000685193705

BG2: AI Semiconductor Landscape featuring Dylan Patel

Dylan Patel has become the “go to” analyst for all things AI and semiconductor-related, and he publishes an excellent newsletter called SemiAnalysis that I subscribe to. Although a lot has changed just in the past 45 days since this podcast was released (DeepSeek!), it provides a great overview of how the hyperscalers are approaching 2025, the opportunity for model scaling, and the importance of optimizing networking and memory, plus much more.

Luke Gromen: 2025 Outlook

It is a critical time for U.S. monetary/fiscal/geopolitical policy, with Scott Bessent, the new Treasury Secretary, commenting before the election that we are in the “middle of a Bretton Woods realignment.” While Luke Gromen, who publishes the Forest From The Trees report has no connection to Bessent or Trump, he is an out-of-the-box and thought provoking thinker on monetary policy and the evolving status of the USD as a reserve currency. In this podcast (I would recommend listening at about 1 hour in), he discusses USD, gold, Bitcoin, National Security, Musk’s DOGE, and more. Even though I don’t agree with all of his points, I think he’s directionally correct and it is important to be thinking about stuff like this right now…

**

A Selection of Recent Tweets from @RagingVentures:

2025 JANUARY EFFECT STOCK IDEAS

One of my favorite pastimes is searching for ideas during tax loss selling season. There are a number of compelling ideas this year, particularly in mid-cap land, despite the market's strong returns.

Here's a few that I own right now:

1/10

— Raging Capital Ventures (@RagingVentures) December 31, 2024

I was told $DUK is basically "out of" extra power in the Carolinas, as $MSFT has gobbled everything up. $DUK does not currently expect new supplies until 2033, a major issue for local manufacturers. Richmond & Atlanta are also apparently similarly tight.

— Raging Capital Ventures (@RagingVentures) January 29, 2025

Update letter from interim $NNDM CEO. Highlights include new $150 mm buyback and an expectation that $NNDM's "core business (pre-2025 mergers)" are expected to be cash flow positive by Q4 2025.$NNDM says it is "in compliance" with its rights and obligations under the $DM and… https://t.co/rcF0Qe25u0

— Raging Capital Ventures (@RagingVentures) January 29, 2025

$PACK with a big win at $AMZN, validating $PACK's investments in next gen packaging automation solutions. $AMZN could earn up to 18.7 mm warrants at $6.83 in return for up to $400 mm of spending over an eight year period. I bought some $PACK this morning. https://t.co/nsW2da6iFX

— Raging Capital Ventures (@RagingVentures) January 29, 2025

Alphawave $AWE.L $AWEVF put out a bullish Q4 trading update earlier this week

New bookings were $185 mm in Q4, well above the recent $100 mm quarterly range. Notably, that included $85 mm of silicon orders – highlighting Alphawave's shift to selling custom silicon and not just…— Raging Capital Ventures (@RagingVentures) January 25, 2025

Holy Cow $FPH!

$178 mm of 2024 net income, even after $50 mm+ of annual interest expense (they will start calling bonds more aggressively this year and likely refi altogether)

Sees 2025 net income of nearly $200 mm

147 mm fully diluted shares. Stock closed at $4.06 per share.…

— Raging Capital Ventures (@RagingVentures) January 24, 2025

Some pre-market shorts today: $SOFI, $PTON, $RGTI, $SOUN, and $IONQ.

Wish me luck!

— Raging Capital Ventures (@RagingVentures) December 27, 2024

Biden “blocked” Nippon’s $55 takeover of $X, after a deadlocked CFIUS decision. Not a great outcome for Japan, a key U.S. ally, but such is the reality of election year politics.

I would have thought a compromise could have been found (create a separate board of directors made… https://t.co/RXgNFPxNof

— Raging Capital Ventures (@RagingVentures) January 3, 2025

**

“You can avoid reality, but you can’t avoid the consequences of avoiding reality.” – Ayn Rand